Preconditions

- Natural persons with a permanent domicile in Switzerland

- Swiss citizens and foreign nationals with B or C residency permits

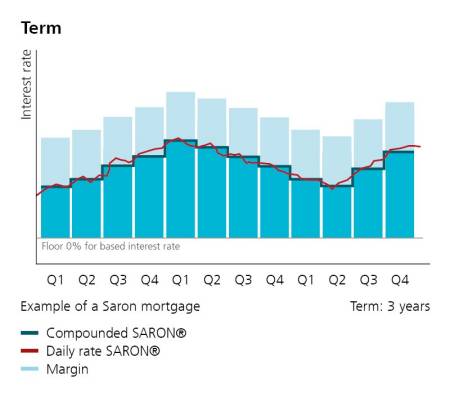

With the PostFinance Saron mortgage, you will benefit from a steady or falling interest rate environment. You take out a mortgage for a fixed term of three years, but you can still remain flexible. The interest is adjusted every three months during the mortgage term.

Term: three years, term concludes at the end of each quarter

Interest rate based on the Compounded SARON®

Option to switch to a fixed-rate mortgage at the end of each quarter

Direct or indirect amortization via retirement savings account 3a, PostFinance retirement funds or life insurance policies

Currency |

CHF |

|---|---|

Maximum amount |

|

Reference interest rate |

Compounded SARON® |

Interest due dates |

Quarterly (31.03 / 30.06 / 30.09 / 31.12) |

Payment method |

Payments due are debited to the private account via Direct Debit |

Interest rate for new business valid as of 26.04.2024

Term |

3 years |

|---|---|

Interest period |

3 months |

Base interest rate + guide margin |

The framework term is three years.

The interest rate is based on the Compounded SARON®, is calculated 5 days before the interest date and is valid for the relevant quarter. This means the interest rate is only known at the end of the interest period.

The interest rate can vary significantly depending on the market situation. This benefit is passed on directly and swiftly in the event of rate cuts. If, however, the Compounded SARON® is negative, this is replaced by 0.00%.

There is also the option of switching to a PostFinance fixed-rate mortgage at the end of the quarter.

All interest rates apply to first-class residential real estate and borrowers (best creditworthiness). Individual customer interest rates are set according to risk. This means the loan-to-value and financial burden ratios for individual customers have an impact on the amount of interest payable.

The interest rate of the Saron mortgage is based on the Compounded SARON® rate in addition to the agreed contractual margin.

The SARON® is the new Swiss reference interest rate. This is calculated and published on a daily basis by SIX based on the money market transactions made that day. The interest rate of the Saron mortgage is based on the Compounded SARON®. This is determined five calendar days before the end of the quarter based on the individual SARON® daily interest rates over the past three months. As this is only calculated five days before the interest date, the interest rate is still unknown at the beginning of the respective quarter. The contractually agreed individual margin (surcharge on the reference interest rate) is fixed for the full term.

CHF 100 |

Extension fee |

|---|---|

CHF 250 |

Credit modification fee (such as change of borrower, change of collateral, change of mortgage to another provider upon expiry, extraordinary amortization or suspension/change of amortization) , Switch from a LIBOR mortgage/Saron mortgage to a fixed-rate mortgage, increases |

CHF 500 |

In the event of a premature withdrawal from the credit agreement |

Third-party fees (e.g. land register fees or notary costs) will be passed on to the borrower.

With a mortgage, you receive a discount of CHF 5 on your banking package.

PostFinance works with the following cooperation partners to offer financing services: Valiant Bank AG, Münchener Hypothekenbank eG, Munich, and CredEx AG, Zurich.