For us, sustainability is more than just a buzzword – it is an integral part of our corporate strategy and our everyday actions. As the bank for Switzerland, we take our responsibilities seriously: for our employees, our operations, our customers, as an investor, for our market services and as an active partner in the Swiss financial center.

Investment business and sustainability

Sustainability-related investment

You are here:

As the bank for Switzerland, we are committed to sustainable business activities. Sustainability is firmly enshrined in our company and our strategy. Rather than investing your money according to conventional financial criteria, PostFinance offers you the ability to use ESG factors to minimize sustainability-related financial risks or to explicitly generate a sustainability impact. ESG refers to environmental, social and responsible governance. We help you find the best possible solution for you personally.

Sustainability-related investment has been around for some time now, and has developed rapidly in recent years. Here at PostFinance, we also want to play our part.

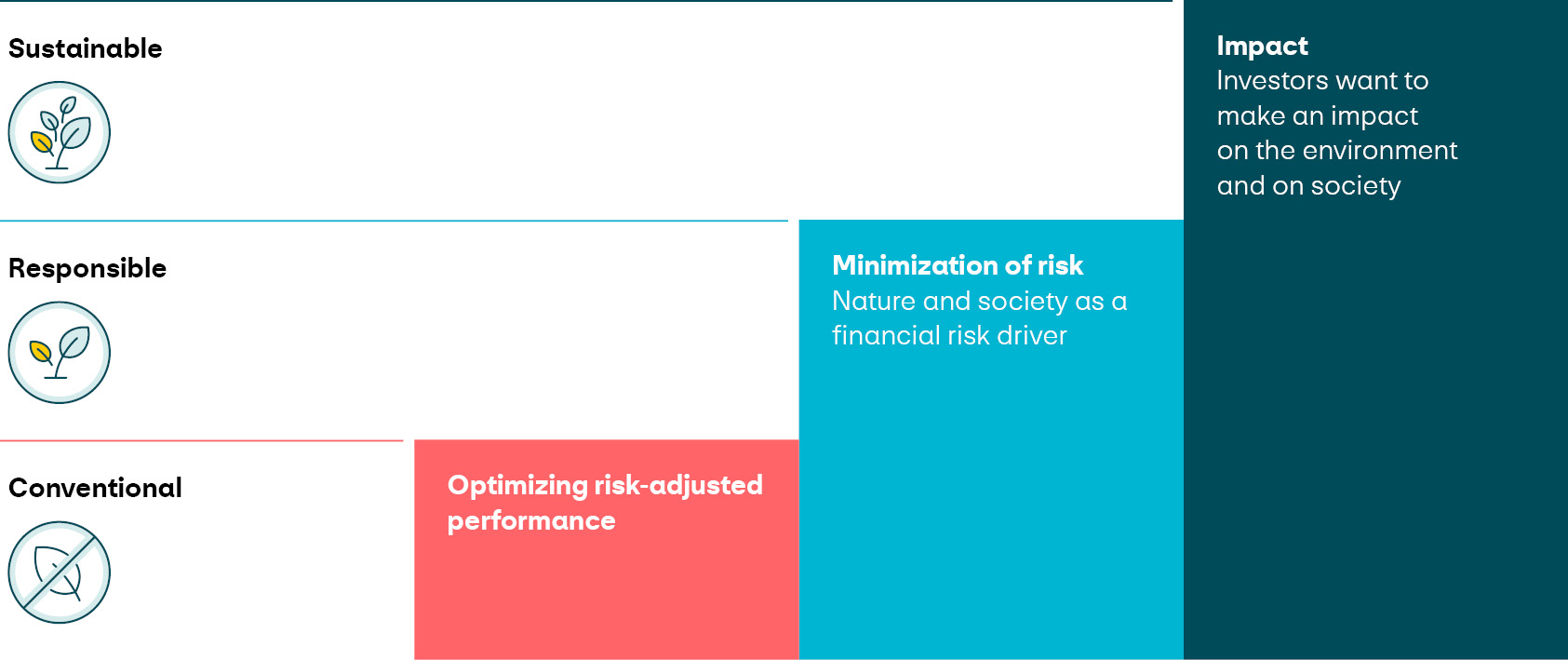

The Federal Council has enshrined sustainability as a pillar of the Swiss financial market strategy and set itself the ambitious target of transforming Switzerland into one of the leading locations in the world for sustainable finances. But what is sustainability-related investment exactly? We distinguish between three categories.

PostFinance investment categories

-

The fundamental investment process focuses exclusively on financial key figures like profitability, liquidity and security. ESG factors are not taken account in the investment process, and the investments do not aim to have a sustainability impact.

-

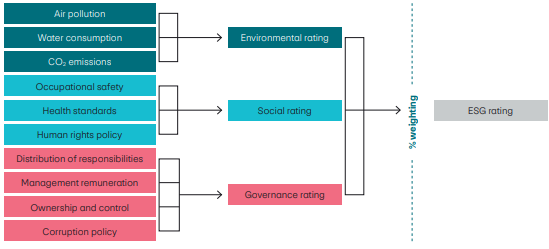

In addition to the financial analysis, ESG factors with an impact on investment performance are also incorporated into the investment decision. The best-known and most widely used system for assessing sustainability-related investments is the ESG rating. ESG stands for environment, social and governance. Most ESG ratings provide insights and information about how well a company is managing sustainability-related risks (financial materiality).

The ESG factors allow you to assess the extent to which a coffee-producing company analyses and considers the impact of climate change on coffee production, for instance. These analyses are designed to persuade investors to favour companies that have a better grip on risks of financial relevance, such as climate change. This is because climate change can have a seriously adverse impact on coffee production and, in turn, the company’s profitability. The following illustration shows the basic scheme that can be used to establish an ESG rating.

Source: Staub-Bisang/Stüttgen/Mattmann (2022) -

These investments aim to have a positive environmental or social impact. In addition to sustainability-related financial risks (financial materiality), the outlook in terms of impact (impact materiality) is also taken into account. Where both dimensions are applied, this is known as “double materiality”. In addition to a better risk-return profile, investors also want to have an impact on the environment and/or society. Investors try to have a sustainability impact by making targeted investments in companies, projects or financial products that are compatible with one or more sustainability goals, or that make a measurable contribution towards one or more sustainability goals – for instance, reducing CO2 emissions or advancing social justice.

-

For an investment to be defined as responsible or sustainable, it must cumulatively meet various criteria. These criteria all relate to the financial instrument.

For a responsible investment, the following criteria must be met:

- The brochure for the financial instrument clearly refers to the goal of reducing sustainability-related financial risks.

- Over the course of the investment process, at least two other sustainable investment approaches are used, in addition to exclusions. “Overview of PostFinance’s sustainability approaches” contains descriptions of these sustainable investment approaches: ESG integration, best-in-class, thematic investments, engagement and voting.

- ESG factors are taken into account for at least 70 percent of the invested assets of the financial instrument and all three sustainable investment approaches applied.

For a sustainable investment, the following criteria must be met:

- The brochure for the financial instrument clearly refers to the goal of the sustainability impact.

- Over the course of the investment process, at least three other sustainable investment approaches are used, in addition to exclusions. “Overview of PostFinance’s sustainability approaches” contains descriptions of these sustainable investment approaches: ESG integration, best-in-class, thematic investments, engagement and voting.

- At least 80 percent of the invested assets of the financial instrument are compatible with one or more sustainability goals or contribute towards reaching these goals.

-

Sustainability is a broad term, and understanding of it varies significantly. At the same time, customer expectations are constantly evolving. As a result, PostFinance is committed to providing its investment customers with ESG and sustainability information on financial instruments that is easy to access and understand in order to give them the ability to make informed decisions. In the ESG and Swiss Climate Score reports, PostFinance regularly publishes information on sustainability-related financial risks and climate impacts for all PostFinance Fonds and PostFinance retirement funds, as well as all e-asset management and investment consulting plus mandates. The various technical terms used in the ESG and SCS reports are described in the glossary below.

Below, we provide an overview of the different sustainable investment approaches.

-

Exclusion (also known as negative selection or standards- or values-based exclusion) is when a conscious decision is made to exclude investments in specific companies, countries or issuers from a portfolio. The exclusion criteria can relate to different aspects, such as product categories, business activities or practices. Exclusions can be divided into two main groups:

- Unconditional exclusions of products or business activities that conflict with the investor’s values (e.g. arms production) – also referred to as values-based exclusions – or that entail excessive ESG risks (e.g. coal mining)

- Conditional exclusions of companies based on their negative business practices, such as violations of certain standards, regulations or global ESG standards (e.g. systematic human rights violations) – often referred to as standards-based exclusions.

Please note: there are various forms of exclusion criteria, and they are defined with varying degrees of stringency, depending on an investor’s goals and preferences. However, if an activity is prohibited by applicable laws and guidelines, its exclusion cannot credibly be used as an exclusion criterion for a responsible and/or sustainable investment. For example, the Federal Act on War Materiel prohibits the financing of controversial weapons in Switzerland. This means that investments that exclude only controversial weapons manufacturers or companies should not claim use of the “Exclusion” sustainability approach. Nevertheless, it makes sense to inform investors about use of this criterion.

-

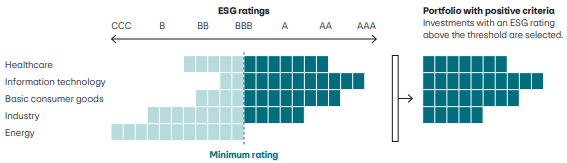

Positive selection is when investments must meet certain binding minimum sustainability criteria if they are to be considered for investment. Minimum criteria can be defined based on factors such as sustainability ratings or other sustainability indicators.

In the following example, a defined minimum ESG rating of BBB is defined for positive selection (on a scale from AAA to CCC). Companies that do not fulfil this criterion are excluded from the investment universe for the fund in question.

-

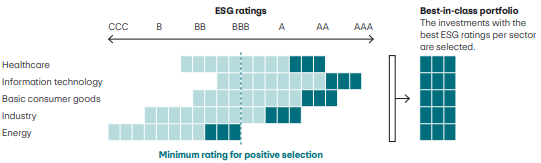

The best-in-class approach is used to consider investments classified as better in terms of environmental, social and governance (ESG) performance within their category, sector or peer group. All issuers with a rating above a predefined threshold are considered investible. The threshold can be defined in different ways. Sectors in this approach can also include those in which the products or production methods are not considered sustainable per se, but the leading companies in terms of sustainability within the industry are considered. This is why the portfolios for many sustainability funds include companies in sectors you would not expect to find, such as those in the chemical, petroleum and automotive industries.

The following illustration shows an example of how the most sustainable companies are taken into account for each sector. Unlike with positive selection, energy companies are part of the portfolio in this example of the best-in-class approach.

-

E-tilting or ESG tilting forms part of the best-in-class approach. The “tilting” approach relates to modifications in the weightings of portfolio components based on the portfolio’s sustainability goals, for instance the environmental (E) or ESG profile (environment, social and governance). This means the weightings of the individual components in the portfolio are adjusted according to their environmental profile or ESG profile to reach the portfolio’s sustainability goals.

-

ESG integration is the direct incorporation of ESG opportunities and risks into traditional financial analysis. ESG criteria are factored into investment decisions by means of a systematic process and appropriate research sources. This means that, in addition to criteria relating to finances, liquidity and business model, an investment must also meet certain sustainability criteria.

-

The climate orientation of a portfolio relates to the long-term reduction in the environmental footprint by cutting greenhouse gas emissions. Greenhouse gas emissions should be in line with the definition of the Greenhouse Gas (GHG) Protocol and cover at least Scope 1 and Scope 2, and ideally also Scope 3 as well in sectors where Scope 3 emissions constitute a material proportion of total emissions. The climate orientation should frame a long-term goal that is supplemented by intermediate goals. The methodology applied should be based on internationally recognized standards such as the PAII Net Zero Investment Framework, the UN Asset Owner Alliance Target-Setting Protocol or the Science Based Targets Initiative for Financial Institutions.

-

Company dialogue is when investors rely on using their rights as shareholders to influence companies, with the goal of persuading companies’ management to give due regard to environmental, social and governance criteria. This is a dialogue that includes both communication with companies’ Executive Board and Board of Directors and submission of or support for shareholder proposals. Where successful, engagement can lead to companies changing their strategy and processes with a view to improving ESG performance and reducing ESG risks. Engagement can take the form of direct interactions between an investor and an investee or of cooperative engagement, where several investors come together with a view to conducting a shared dialogue.

The term exercise of voting rights refers to the active exercise of voting rights by investors based on ESG principles, with a view to expressing their concerns about environmental, social and governance issues.

Each investment must pursue a goal. Perhaps you care about increasing the value of your investment or preserving assets for the next generation, or maybe you want investments to reflect your values. Whatever your goals are, sustainable investments may be a solution. The first thing investors need to do is answer a few important questions.

Clarify the investor/risk profile

- Investment goals: decide on investment horizon, risk capacity/appetite, investment purpose and investment limitations

- Consider expertise and experience

- Define financial circumstances

Clarify ESG profile

Part of this enquiry also includes clarifying the ESG profile. As per the self-regulation of the Swiss Bankers Association (SBA), PostFinance asks customers that use investment consulting for their preferences, and in so doing, determines to what extent they are interested in sustainability issues. All these customers undergo a profiling process. The relevant profile is then derived based on their ESG preferences. There are a total of four ESG profiles, which are presented below.

Sustainable

Your ESG profile shows that you value sustainable investments. This means that you want your investments to have a measurable impact on one or more of the United Nations’ Sustainable Development Goals (through compatibility or contribution).

Responsible with ESG preference

Your ESG profile indicates that you want to consider the potential impacts of environmental, social and governance factors (ESG) on investment performance.

Responsible

Your ESG profile shows that you want to make allowance for ESG/sustainability aspects and their potential impact on investment performance in your investments, but do not have a specific ESG preference.

Neutral

Your ESG profile shows that you have a neutral attitude towards sustainable and responsible investments. This means that you are open as to whether your investments are conventional, responsible or sustainable.

Based on the ESG profile, various investment/retirement planning solutions and focuses are suitable.

Risks of responsible and sustainable investments

As with conventional investments, responsible and sustainable investments also come with risks to bear in mind. These can be found in the brochure “Risks Involved in Trading Financial Instruments”. There are no risks that exclusively apply to sustainable and responsible investments. The same applies to every financial product: past performance of an investment cannot be used to draw conclusions about future development. Empirical studies show that sustainable and responsible investments do not tend to have either better or poorer prospects of a return. When it comes to sustainable investments in particular (with the promise of an impact), it comes down very specifically to the structure of the financial instrument. For example, a guarantee of broad sectoral and regional diversification should be checked. In the ESG and Swiss Climate Score reports, PostFinance looks at the specific sustainability-related risks and impacts for each financial instrument in detail. Here, for instance, we refer to the MSCI ESG rating, the carbon footprint and the proportion of invested companies that pursue a science-based CO2 reduction pathway. For the “investment consulting plus” and “fund consulting basic” investment solutions, individual modifications can be made to the recommended model portfolio. These modifications may mean that the investment amount is not fully invested in accordance with sustainable principles.

Do you have any questions?

Benefit from the knowledge of our team of experts at any time.