Fixed-rate mortgage

Your mortgage for planning security

You are here:

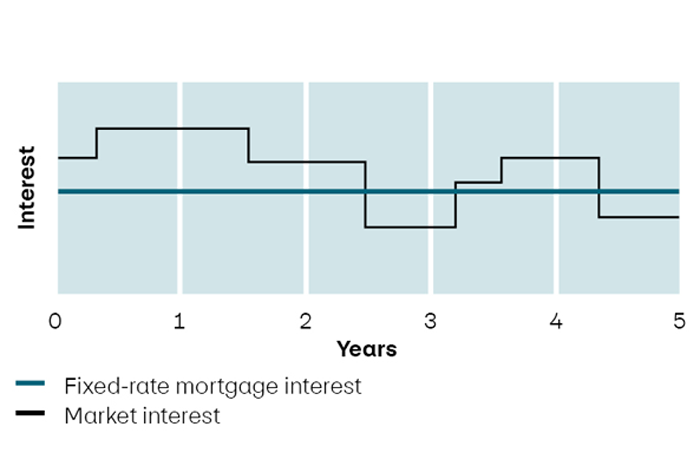

A fixed-rate mortgage allows you to plan your finances reliably. The interest rate remains unchanged throughout your chosen term of 2 to 15 years. That way you can remain relaxed, even in a turbulent market environment.

Fixed-rate mortgage: budget with a fixed amount

-

Don’t pay more when interest rates rise

-

No surprises with your monthly costs

-

Fast online access to your personal offer

-

Free consultation

-

Secure interest rate up to 18 months in advance

More details can be found in the The link will open in a new window Fixed-rate mortgage factsheet (PDF).

Calculate your mortgage and receive an offer

Check whether owning your own home is financially viable and receive your personal quotation – directly online or in a free consultation, with no obligation.

The prices and conditions apply both to initial financing and to the renewal or extension of a mortgage.

Preconditions |

|

|---|---|

Minimum amount |

CHF 100,000 |

Interest due date |

Quarterly |

Loan |

|

Load |

max. 33% of gross income |

Account management |

|

Other conditions, such as for any credit changes, can be found in the price list.

-

A fixed-rate mortgage is the right choice if you like to budget with a fixed amount and expect interest rates to rise. When choosing a suitable term, you should bear in mind that this depends on various factors such as the current interest rates, your financial situation, expected interest rate developments and your personal aspirations.

-

A fixed-rate mortgage allows you to protect yourself against rising interest rates and to calculate your costs clearly. Unlike the Saron mortgage, where the interest rate changes periodically during the term based on market developments, the interest rate remains fixed for the chosen term. That’s why a fixed-rate mortgage is particularly worthwhile when interest rates are low and are not expected to drop any more in the near future.

-

PostFinance works with the following cooperation partners to provide financing services:

- CredEx AG, Zurich

- Münchener Hypothekenbank eG, Munich

- Valiant Bank AG, Bern

-

In our checklist, you will find an overview of the standard documents. Please feel free to contact our experts to clarify your individual situation so that we can assist you in obtaining your documents.

The link will open in a new window Checklist for mortgage application (PDF)

-

With PostFinance, you can choose a term of 2 to 15 years.

-

If you’re able to contribute more equity to finance your own home, for example, the risk for the lender is reduced, so you can generally expect a lower interest rate.

-

Yes, with PostFinance you can secure an interest rate for a fixed-rate mortgage up to 18 months in advance.

-

Yes, you can also terminate your mortgage before the end of the chosen term. Please note that early termination of the contract may result in costs.

-

You can amortize your fixed-rate mortgage directly (the capital amount of the mortgage is reduced) or indirectly (the capital amount of the mortgage remains unchanged) via your retirement savings account 3a and your PostFinance retirement funds or a life insurance policy.

-

Our specialists will contact you in good time to secure the subsequent financing of your fixed-rate mortgage. Together, we will check if the mortgage still suits your current financial situation or if it would make sense to adjust it (e.g. a mortgage model switch).

Your next step towards a fixed-rate mortgage

Calculate mortgage

Find out right away whether owning your own home is financially viable.

Create a quotation online

Create and download your own personal quotation.

Free consultation

Find the right mortgage with us – in a branch, online or by phone.