Collect payments professionally and inexpensively

Ideal for revenue from CHF 100,000: benefit from attractive conditions and flexibility. Which payment terminal and which price plan is best suited to your business?

The payment collection solution for every business

Payment collection in store made easy: Checkout is a comprehensive payment collection solution that allows you to accept all common payment methods with a payment terminal and also lets you keep track of your transactions at any time via the Checkout portal.

Ideal for revenue from CHF 100,000: benefit from attractive conditions and flexibility. Which payment terminal and which price plan is best suited to your business?

The complete payment solution

Popular due to discounts

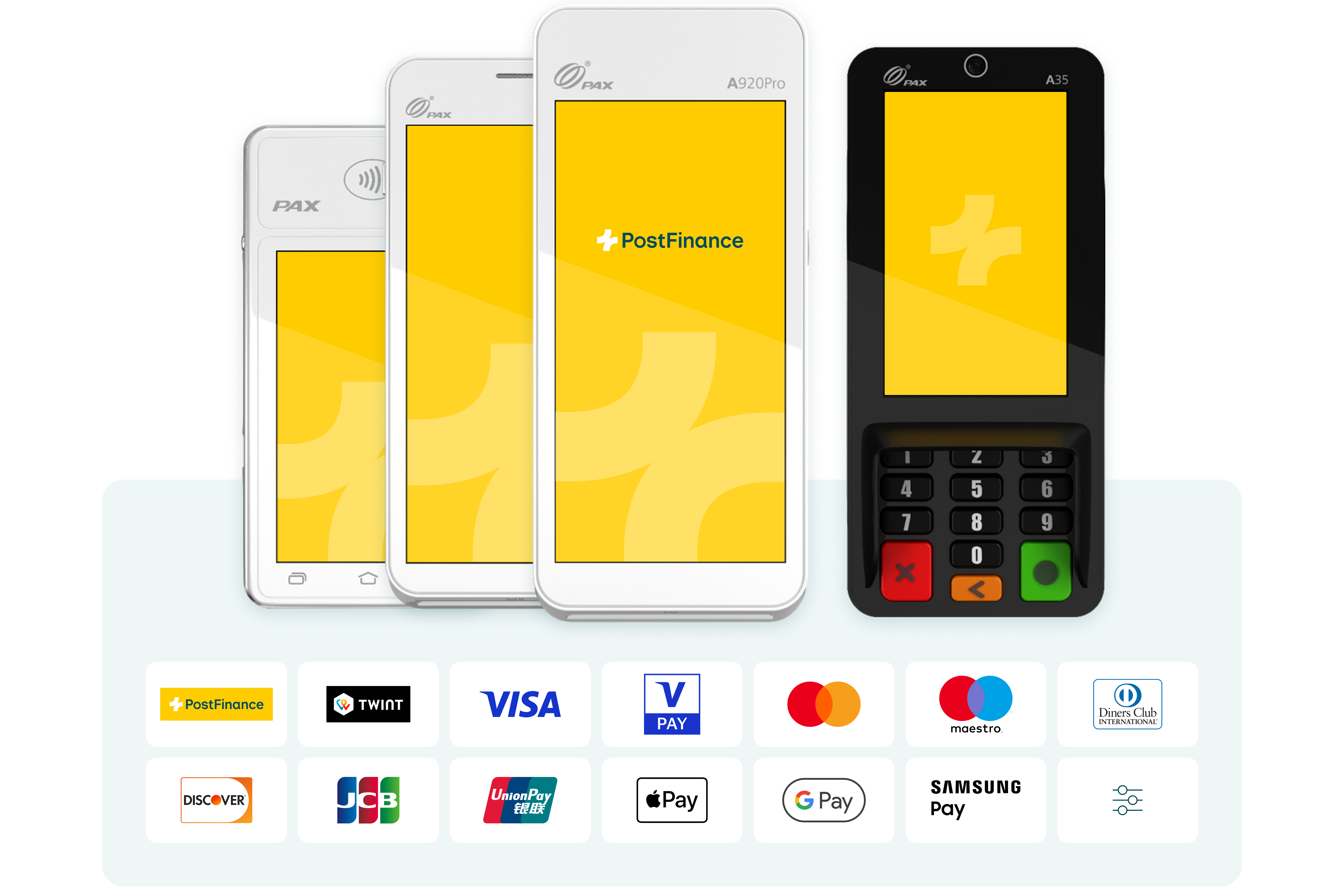

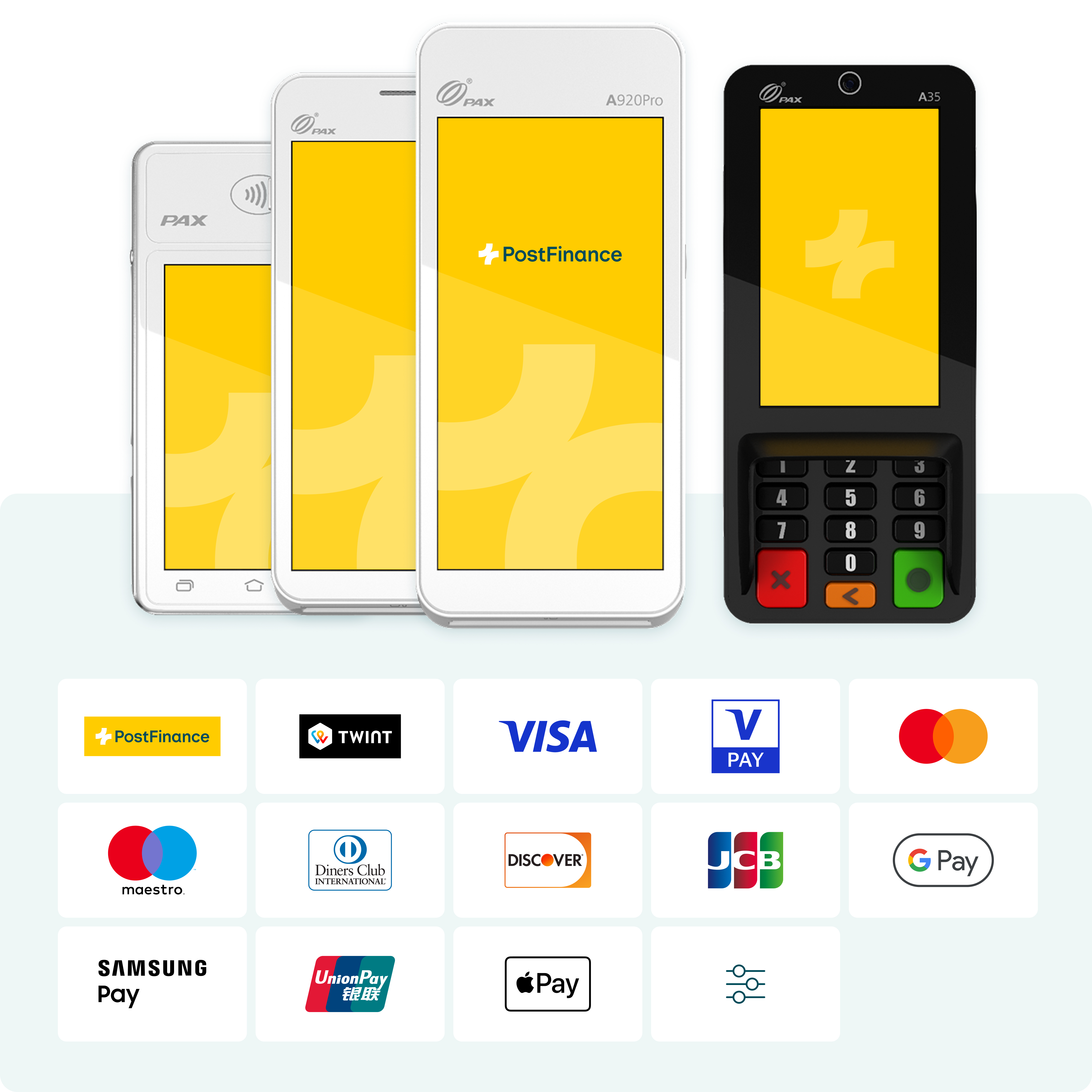

Payment methods

PostFinance, TWINT, Visa, Mastercard, Diners Club/Discover, JCB/Union Pay

The flexible payment solution

Suitable

Payment methods

Free choice of acceptance partners and payment methods

As convenient or robust as possible – mobile or integrated into your checkout? We cover all needs with our four card terminals, from ultra-light mobile starter models to professional devices. You decide which terminal suits you best.

Acceptance partners |

PostFinance |

|---|---|

Payment methods preconfigured |

PostFinance Card TWINT Visa Mastercard Diners Club/Discover JCB/Union Pay |

Manage payments |

The Checkout portal gives you an overview of all transactions processed |

Monthly costs |

CHF 9.90 per terminal Covers the monthly costs for the SIM card and maintenance, including all data transfers |

One-off investments |

Acquisition of payment terminal(s) – from CHF 224.25 Shipping CHF 10.00 Terminal setup free of charge |

Transaction fees |

Debit cards: 1.2% TWINT: 1.3% Credit cards: 1.5% At least CHF 0.12 |

Additional fees |

Chargeback fee: CHF 35.00 per chargeback |

Time until activation |

Five working days |

You are free to choose which acceptance partner best suits your business and send the corresponding contracts to them directly in the Checkout portal.

Manage payments |

With the Checkout portal, you can keep track of all transactions processed |

|---|---|

Monthly costs |

CHF 9.90 per terminal Covers the monthly costs for the SIM card and maintenance, including all data transfers |

One-off investments |

Acquisition of payment terminal(s) – from CHF 299.00 Shipping CHF 10.00 Terminal set-up free of charge |

Transaction fees |

Dependent on the selected acceptance partners and payment methods |

Additional fees |

Selected acceptance partners conditions |

Time until activation |

Dependent on the selected acceptance partners |

Introductory offer for small businesses: fees only apply when collecting payments. With an extra-convenient card terminal.

Payment terminal PAX A50s

CHF 189.00

Payment methods

PostFinance, TWINT, Visa, Mastercard

Prices and fees

With the All-in-One pricing model, you receive a particularly inexpensive and convenient mobile POS terminal with Wi-Fi and 4G connections. Ideal for collecting cashless payments in store and for use on the go − in gastronomy, in the retail sector and at events.

Use |

Battery life: around eight hours with normal use Outdoor use restricted (not ideal in poor weather conditions) Cash integration: no |

|---|---|

Data connection |

4G Wi-Fi (2.4 GHz) Bluetooth |

Length and weight |

13.8 cm 163 g incl. battery |

Price |

Price with Checkout All-in-One (excl. VAT): CHF 189.00 |

We offer additional payment terminals with the Checkout POS Bundle and Checkout Flex pricing models. Compare characteristics and payment terminal prices – everything at a glance.

With the All-in-One pricing model, you receive a single, complete payment solution with no ongoing costs. Fees are only incurred when collecting payments.

Acceptance partners |

PostFinance − in cooperation with our partner Wallee Group AG |

|---|---|

Payment methods |

PostFinance Card TWINT Visa and Mastercard |

Manage payments |

The Checkout portal gives you an overview of all transactions processed |

Monthly costs |

None |

One-off investments |

Acquisition of payment terminal PAX A50s: CHF 189.00 (excl. VAT.) Shipping CHF 10.00 Set-up free of charge |

Transaction fees |

1.7% per transaction At least CHF 0.20 Standardized for debit cards, TWINT and credit cards |

Additional fees |

Chargeback fee: CHF 35.00 per chargeback Manual payment: CHF 2.50/transaction |

Time until activation |

Five working days |

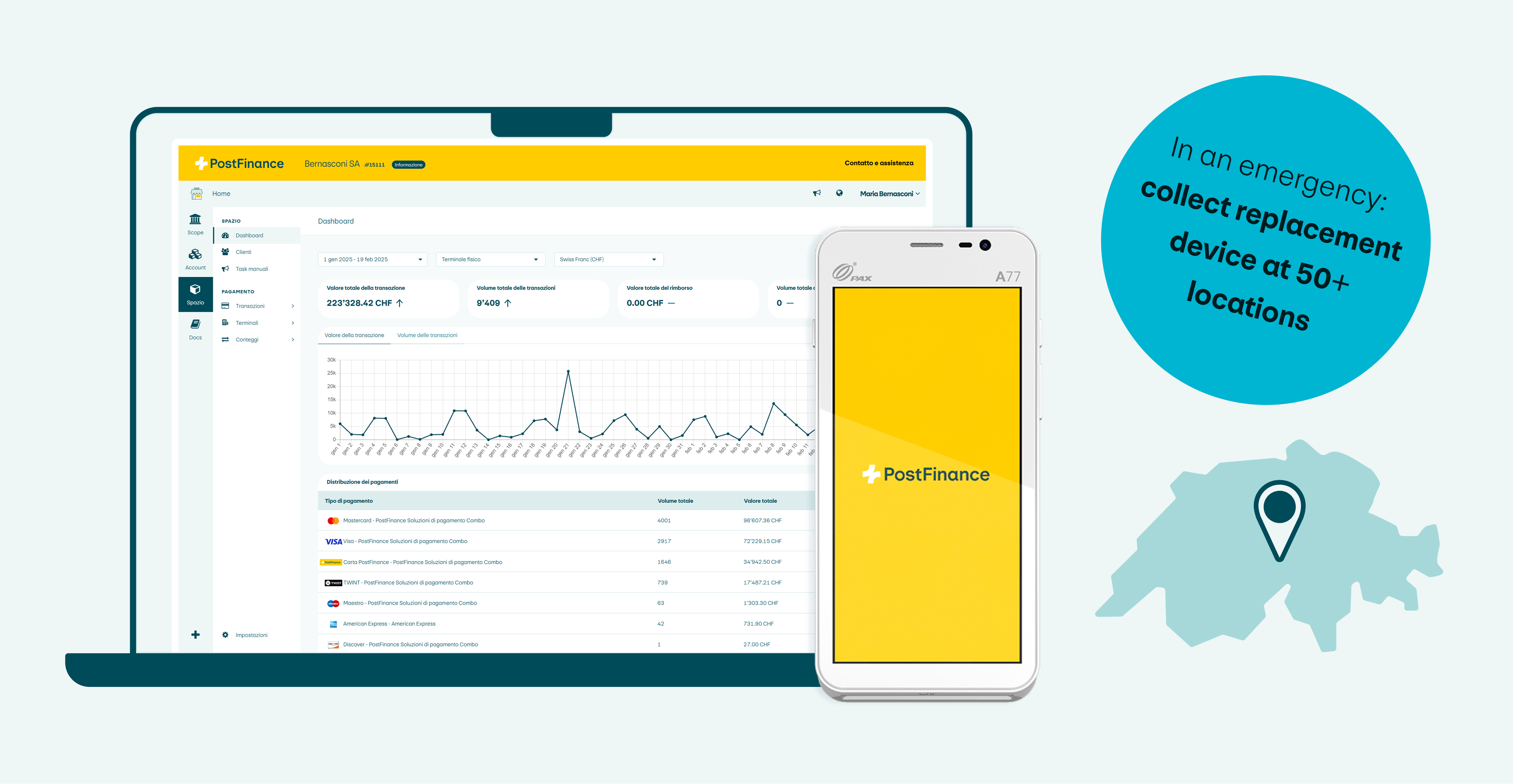

The Checkout portal gives you an overview of your transactions at all times. If you need help or immediate support, such as with replacing a device, we are there for you around the clock and free of charge.

If your card terminal suddenly fails, our SOS box provides you with immediate help. You can receive a replacement device around the clock from over 50 locations around Switzerland – free of charge for all Checkout customers.

You can find the sales reports (reconciliations) of the different acceptance partners and your sales receipts in your Checkout portal. You can export these as a CSV file and import them into your accounting software.

All Checkout price plans can be expanded at any time to an omnichannel solution with sales in the online shop (e-payment).

You can integrate our card terminals into any modern checkout system at the point of sale (POS). The following five solutions are available:

Direct integration (documentation at The link will open in a new window checkout.postfinance.ch)

Indirect integration (communication protocols)

To integrate it into your checkout system, please contact our support team or your provider.

This depends on where you want to use your POS terminal. A mobile card terminal is ideal for the gastronomy sector (restaurants or bars), markets or delivery services – wherever you need to collect payments flexibly. It works via WLAN or mobile phone.

A stationary card terminal is firmly connected to the checkout with cables. It is suitable for shops with a fixed point of sale. PostFinance offers you a suitable model for every sales situation.

A good card terminal should support all the common Swiss payment methods: credit cards (Visa, Mastercard), debit cards, TWINT, mobile wallets and the PostFinance Card. All our POS terminals meet the industry ep2 standard. This means you can offer your customers a smooth and secure payment at the POS.

You make a one-off investment with the purchase of a POS payment terminal that suits your on-site situation. The ongoing costs cover the operation and maintenance of the terminals and services. To optimize ongoing costs, you can choose from the following options:

Tip: with our POS bundle, you benefit from discounts on POS terminal purchases and on your business account fees.

You should never compromise on security. Our POS terminals are PCI DSS and ep2 certified. This is the standard in Switzerland and worldwide. These certifications guarantee that card data is encrypted and processed securely.

Forget about software updates and negotiations with technical providers and simply focus on your core business: PostFinance’s Checkout solutions guarantee maintenance and security, protecting your business and your customers’ data.

A card terminal should be easy to operate and ready for use quickly. Our devices can be installed and operated without any technical expertise. We are there to provide support at all times if you have any problems. You can access your payments and settings around the clock in the Checkout portal.

There are various ways to integrate it into your checkout system to make your processes even more efficient.

In addition to the card terminal, there’s also the service. We have over 100 years of experience in Swiss payment transactions, reliable support and fair contractual conditions.

If you do not want to benefit from the advantages of our Checkout products: together with Worldline, we offer a mobile, easy-to-use card terminal for flexible use in store or on the go: the Link/2500.

We will be happy to contact you and advise you personally.