As in the previous month, the bond market remained relatively calm. The only significant changes were on the Japanese bond market.

You are here:

Market overview: Headwinds following strong start to the year

After a successful start to the year, the financial markets faced growing headwinds over the course of the month. On the equity markets in particular, weaker tech stocks weighed heavily on sentiment. There were also pronounced and at times unsettling fluctuations in precious metal prices. In the meantime, however, the situation has stabilized. The price of gold recovered and saw further gains.

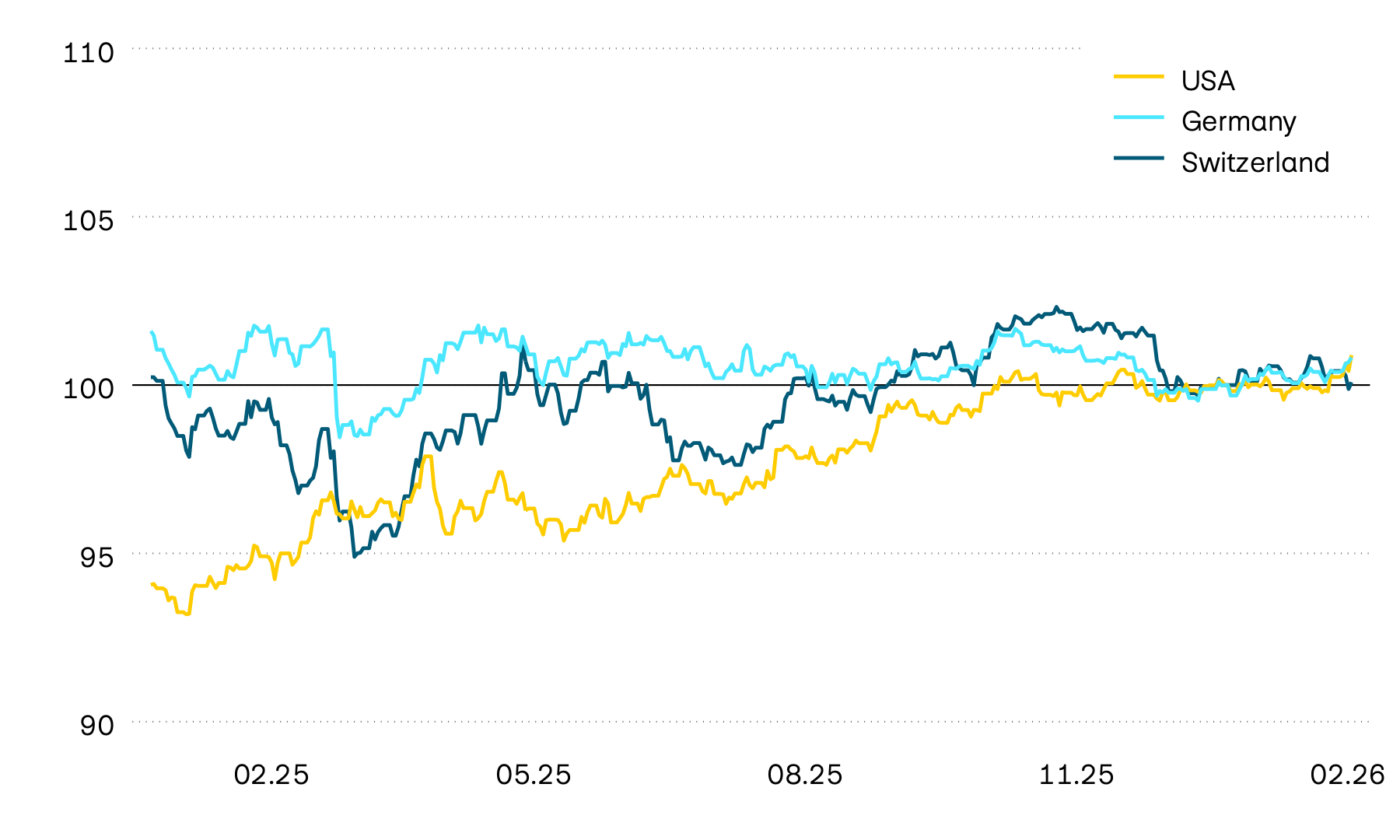

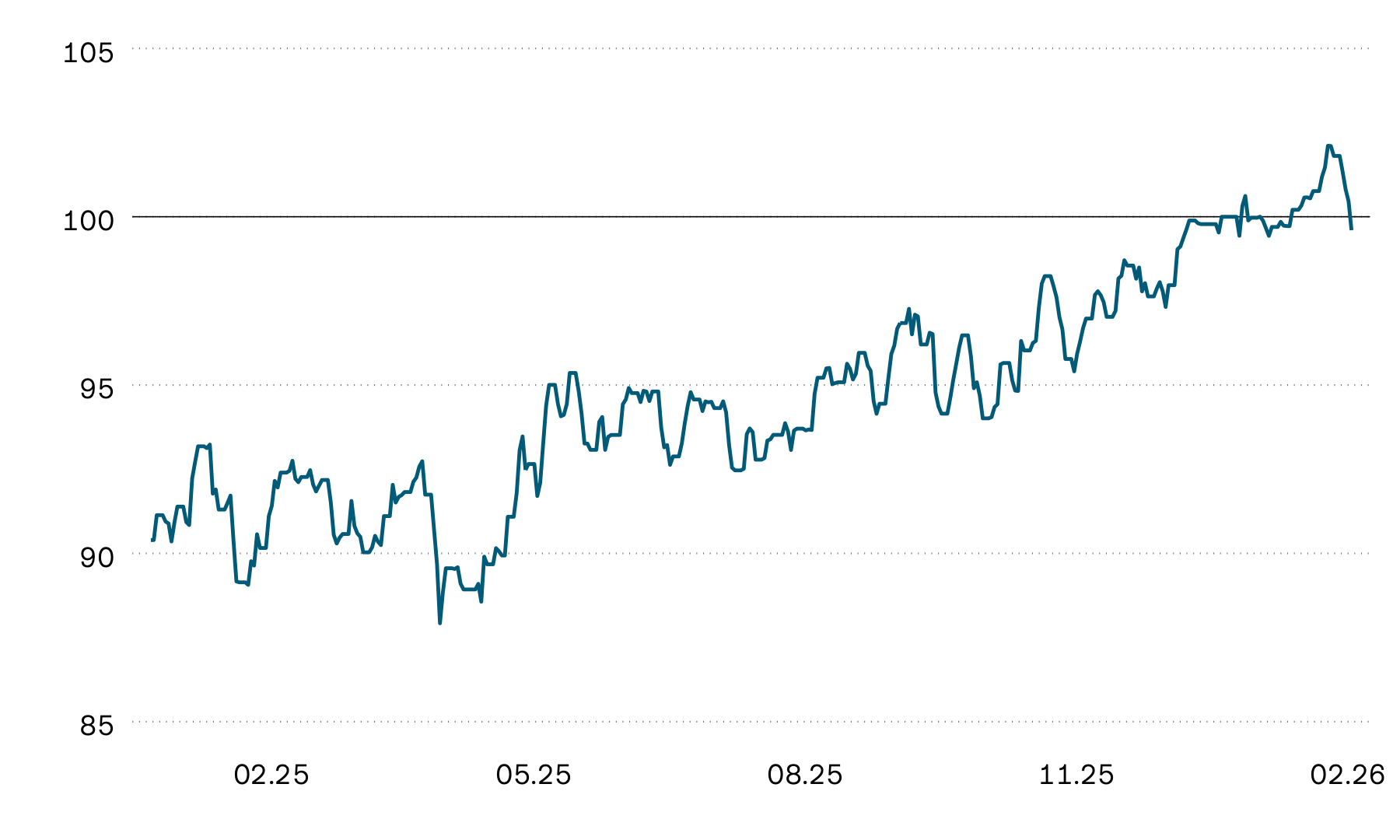

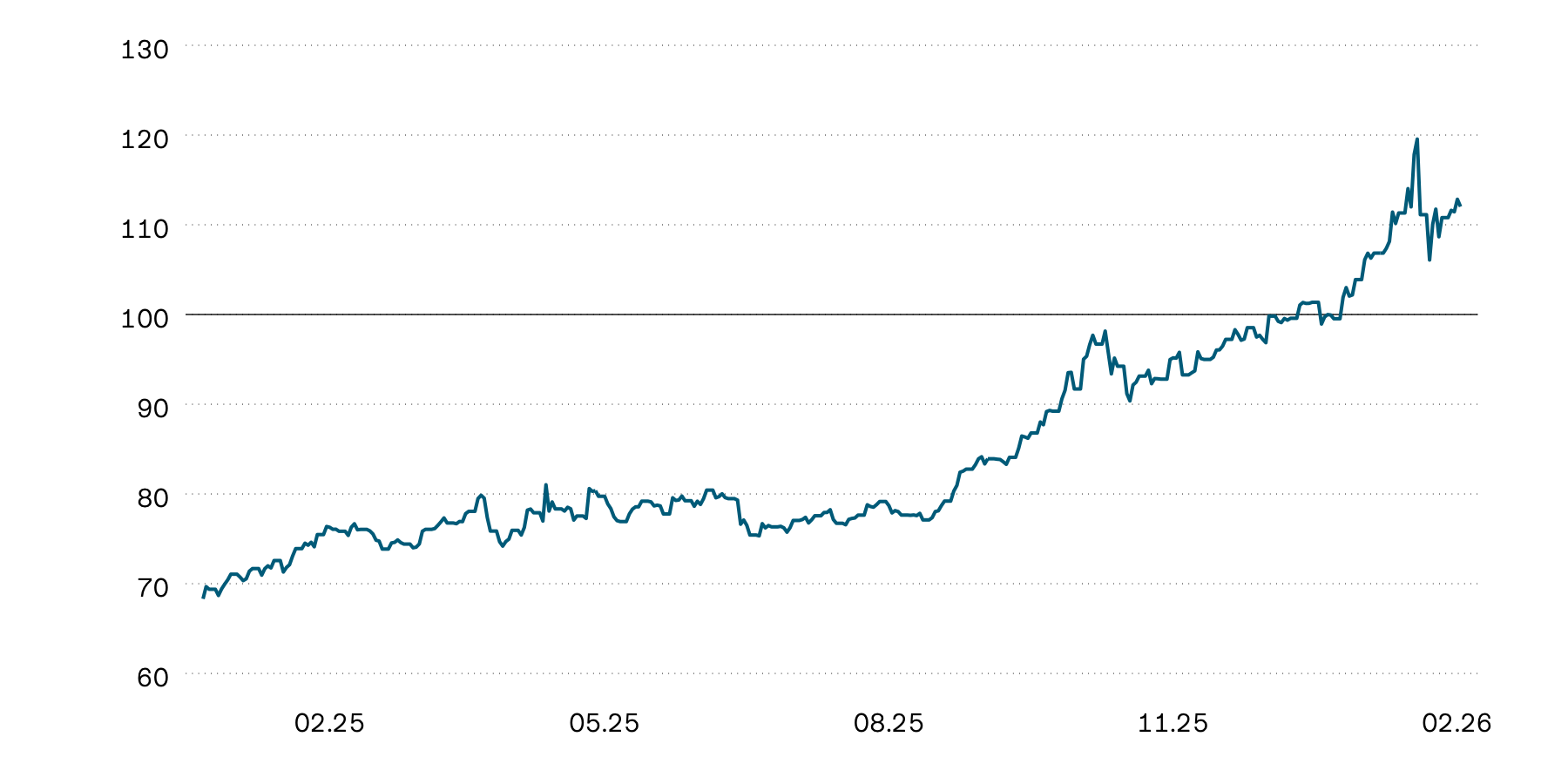

Indexed performance of government bonds in local currency

100 = 01.01.2026

Compared to the previous month, the bond markets in western industrialized nations were remarkably stable. There were no significant market movements in response to either Trump’s apparent call for the annexation of Greenland or to the announcement of Kevin Warsh, seen as a proponent of fiscal restraint, as Jay Powell’s successor at the helm of the US Federal Reserve. The only real turbulence was in Japan, as it held elections for the new lower house. Although the situation calmed down somewhat after the victory of the prime minister’s party, Japanese government bonds still recorded significant losses month-on-month.

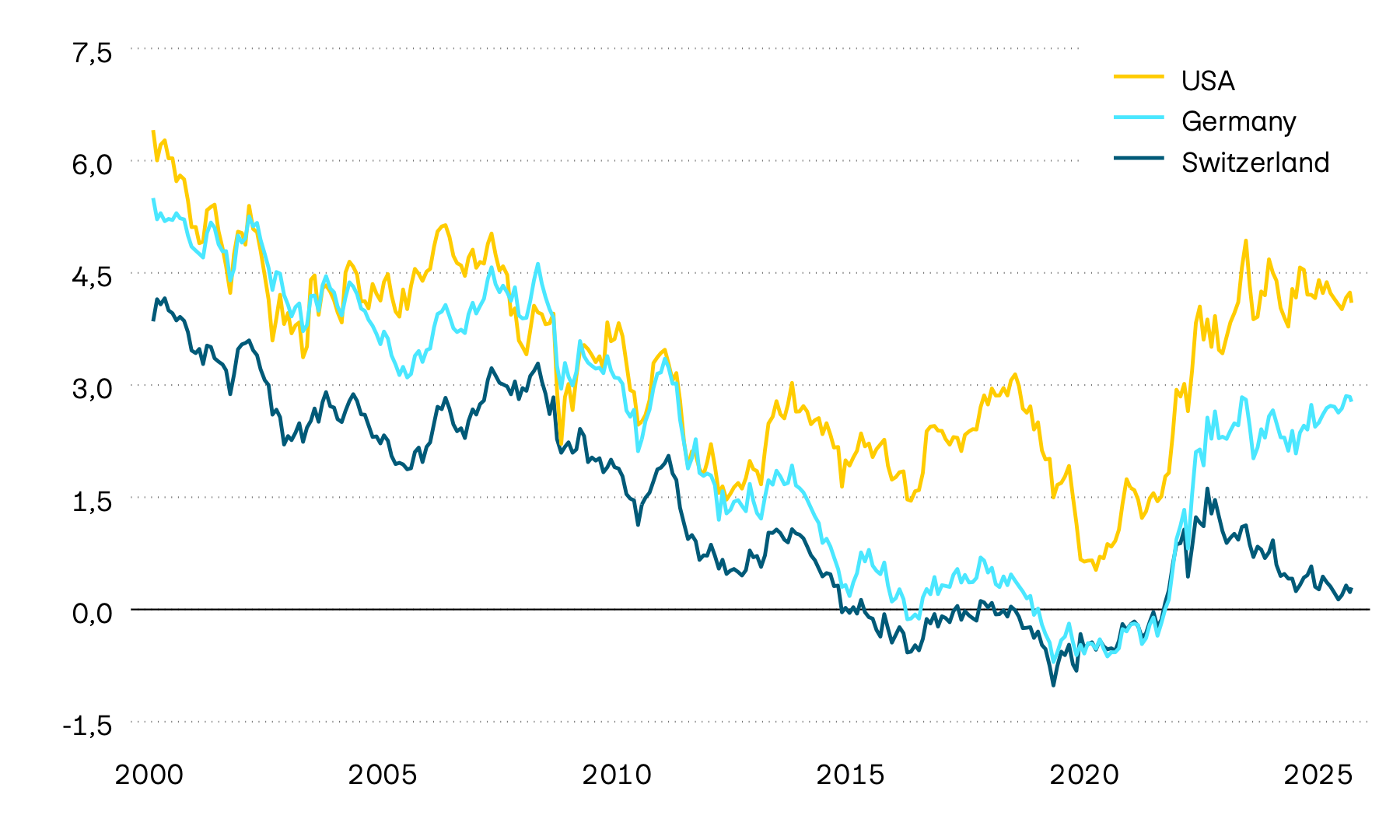

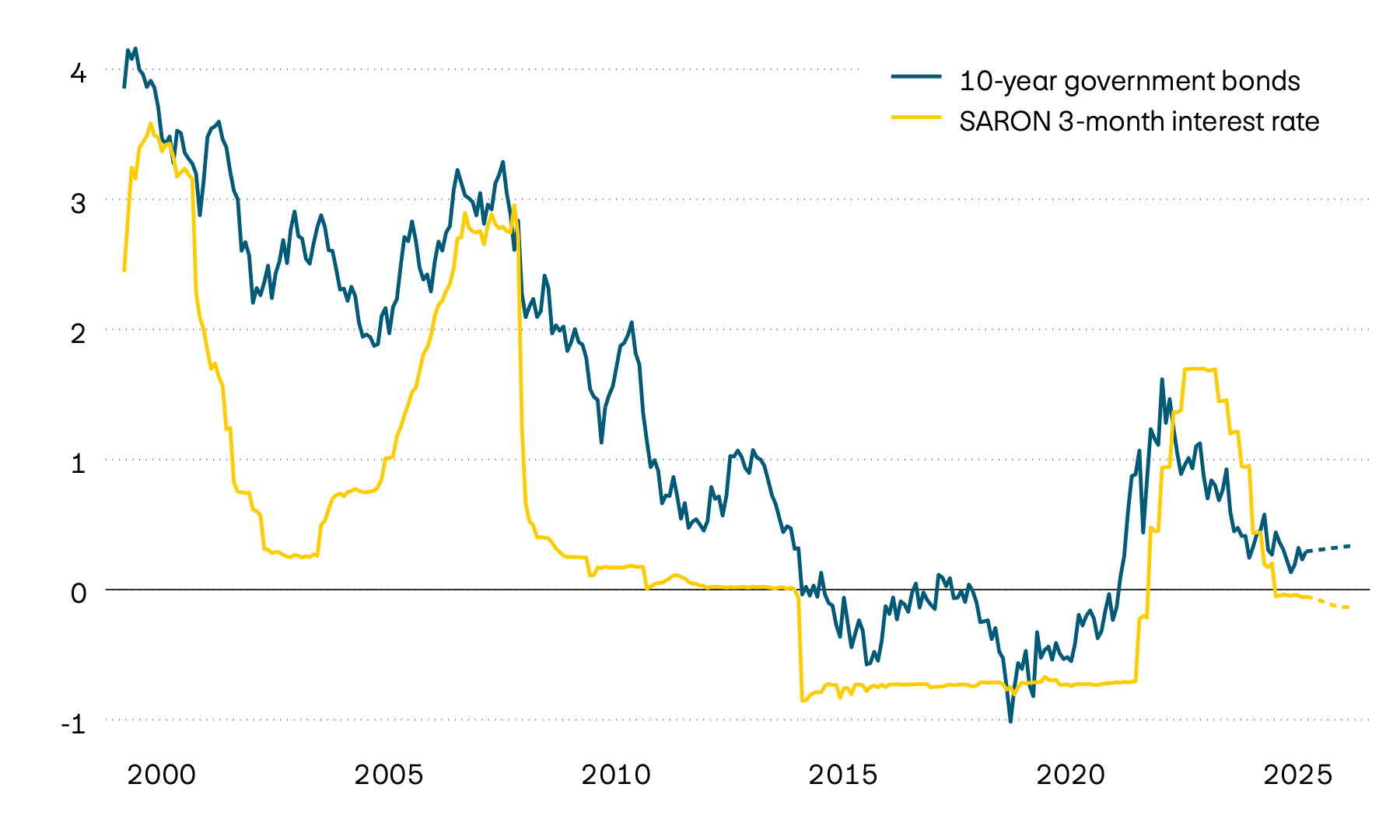

Trend in 10-year yields to maturity

In percent

10-year yields to maturity in most industrial nations remained largely unchanged month-on-month. In Switzerland, 10-year Swiss government bonds continue to trade at just over 0.2 percent. In the USA, 10-year yields to maturity also remain close to 4.2 percent. There were no significant movements in response to either the announcement of Kevin Warsh as new US Federal Reserve Chairman or the latest labour market data, which point to a significant weakening of the labour market. The most significant change was seen on the Japanese bond market, where yields to maturity had already risen significantly since the election of new Prime Minister Takaichi last year. This trend continued at the beginning of the year, reaching its peak with the announcement of fresh elections by the prime minister, who is seen as expansionary in her fiscal policy. Following her election victory, 10-year yields to maturity settled at around 2.2 percent.

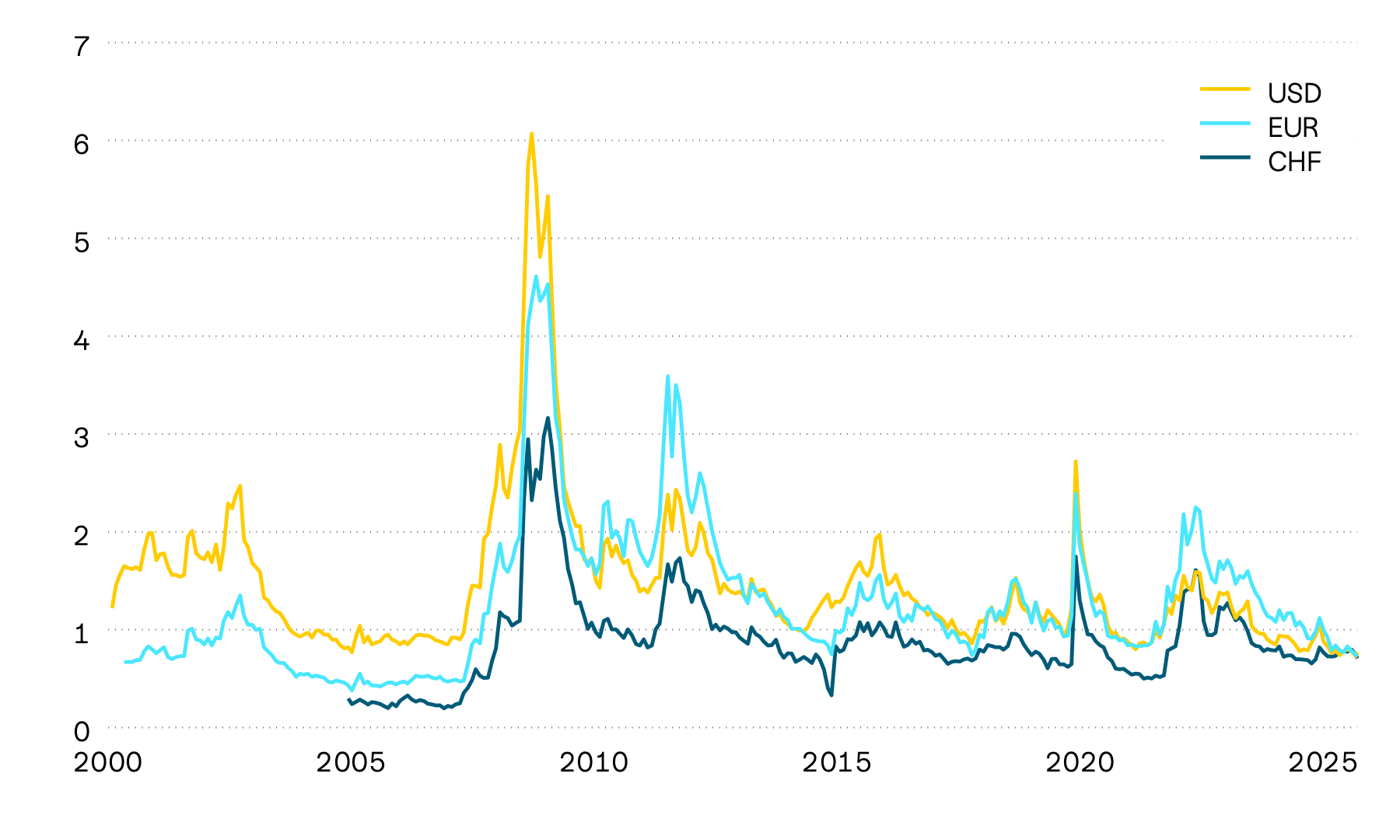

Credit spreads on corporate bonds

In percentage points

Credit spreads on corporate bonds remain virtually unchanged at historically low levels. The recent confirmation of a significant slowdown in the US labour market did little to change this. There are still few signs of any real fears of recession.

Equity prices started the new year with momentum. However, as headwinds gained strength last month, in particular in the technology sector, the tech-heavy equity markets fell sharply.

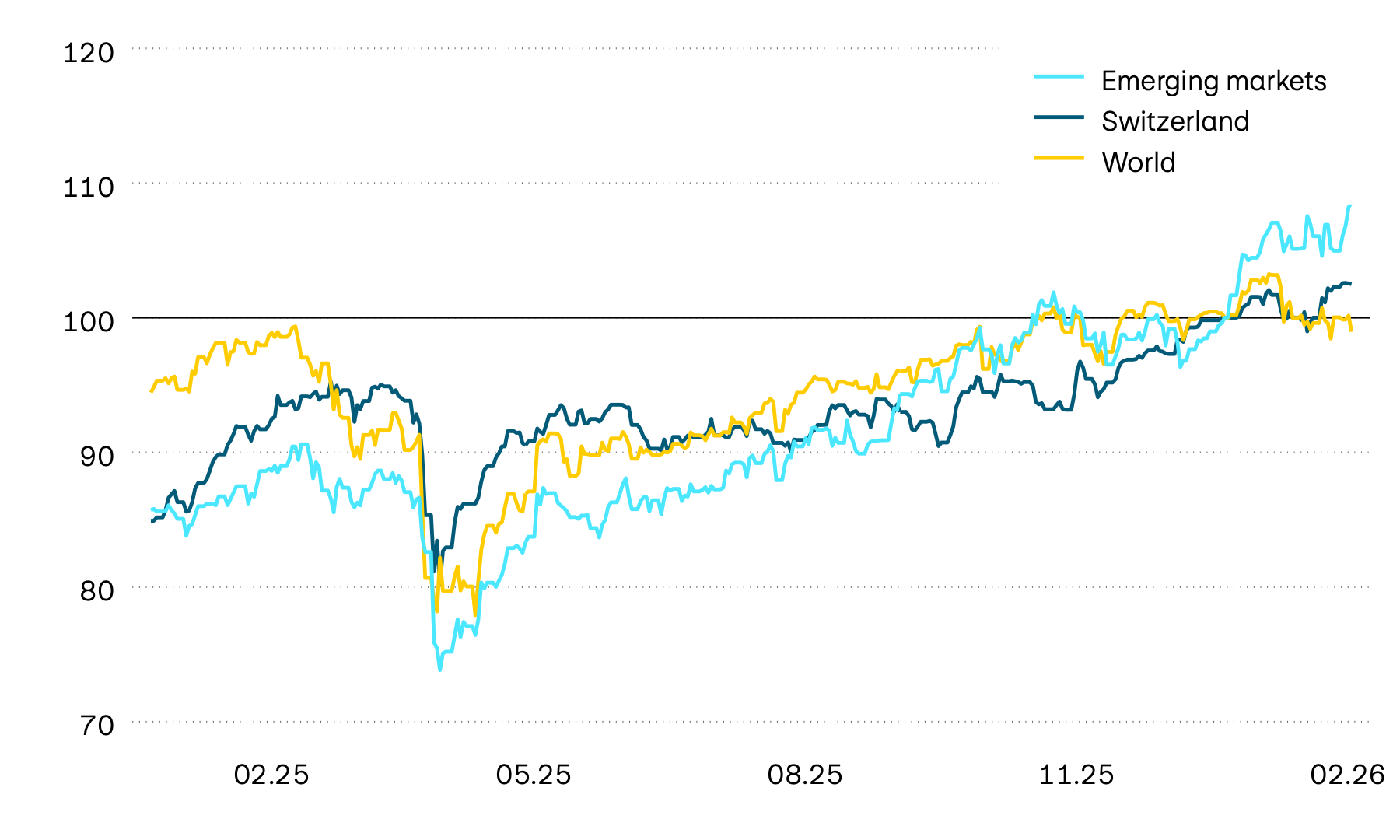

Indexed stock market performance in Swiss francs

100 = 01.01.2026

Following a dynamic start to the new year, the positive trend on the stock markets lost significant momentum last month. Software stocks in particular, which have come under significant pressure recently, weighed heavily on overall performance. One reason for the growing sense of caution is no doubt the very high level of investment in artificial intelligence undertaken by many tech companies such as Microsoft and Amazon, as it remains to be seen when and to what extent this will actually deliver stable returns. The presentation of a new AI model by Anthropic only added to the nervousness. This is a technology capable of performing demanding and knowledge-intensive tasks largely autonomously, making entire value chains the focus of potential disruption. In response, companies whose business models could be particularly heavily affected by developments of this kind were hit hardest.

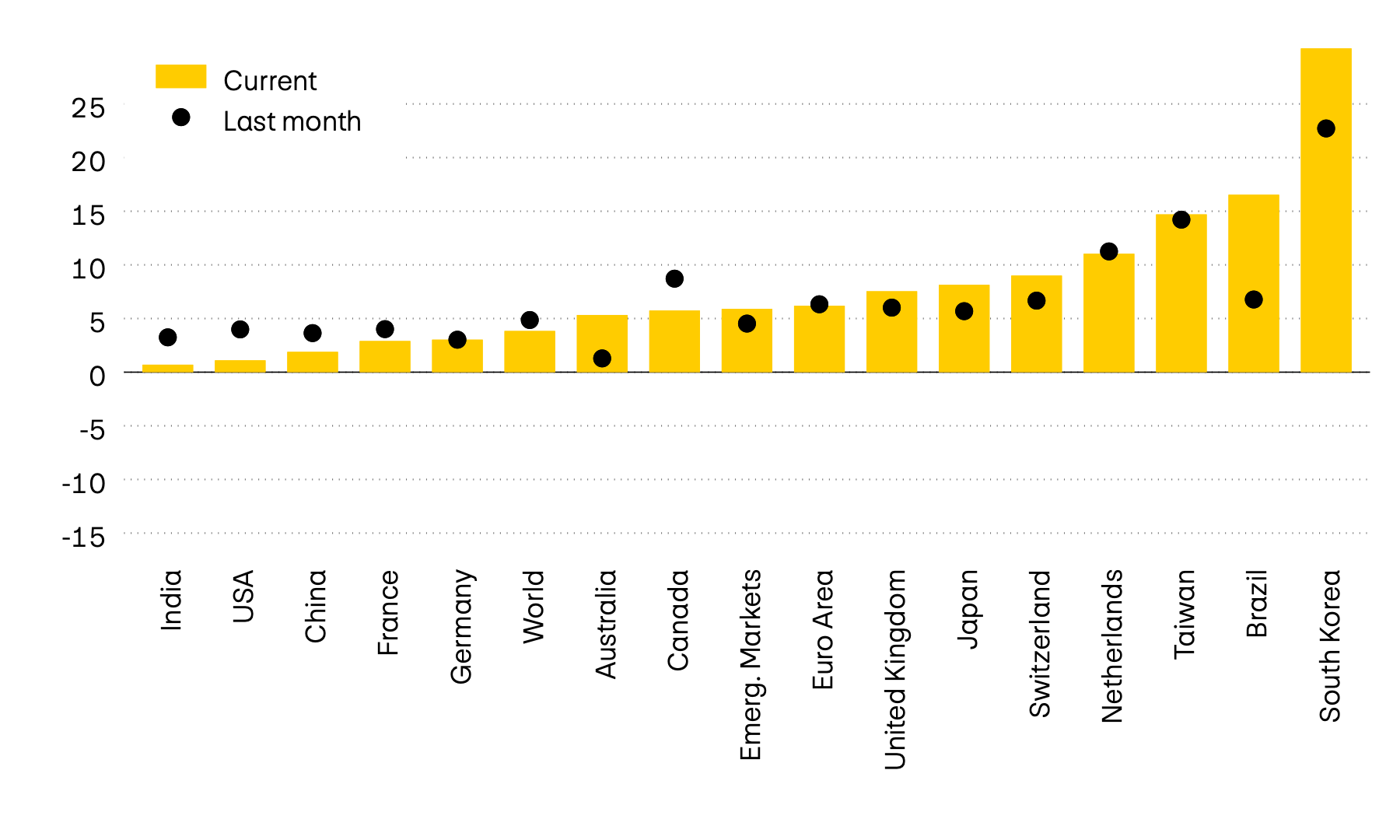

Momentum of individual markets

In percent

Momentum on the stock markets remains positive overall, although it has weakened somewhat in many countries recently. Momentum is therefore now less pronounced than at the beginning of the year. Exceptions include several emerging markets, such as Brazil and South Korea, which likely benefited from both the desire of many investors for broader diversification and the continued weakness of the US dollar. The Japanese stock market has also gained momentum recently. Following the clear election victory of Prime Minister Takaichi, who is seen to be expansionary in her fiscal policy, the markets are likely to bet on additional economic stimulus.

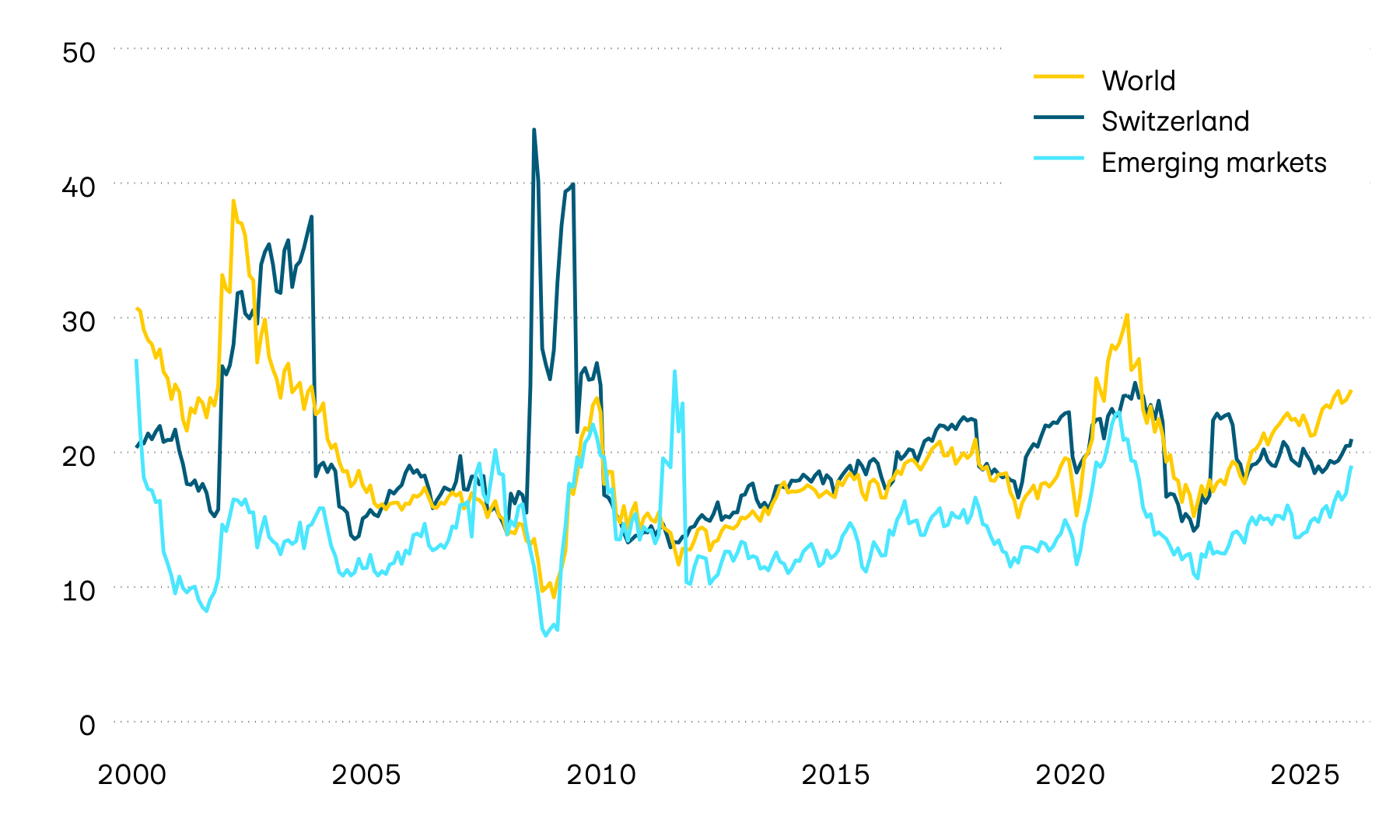

Price/earnings ratio

There was little change in the price/earnings ratio (P/E ratio) in Switzerland and on the global stock markets, with only emerging markets seeing a more significant increase. This is likely mainly due to the positive performance of share prices. Emerging market stocks are again among the frontrunners this year.

Exchange-listed Swiss real estate funds failed to maintain their initial gains and remain close to their starting level over the year.

Indexed performance of Swiss real estate funds

100 = 01.01.2026

After a cautious start to the year, exchange-listed Swiss real estate funds initially gained around 2 percent in value. However, these gains could not be maintained, with the value of real estate funds falling again in recent days. This results in a slight loss for the year to date, which is similar to the pattern seen last year.

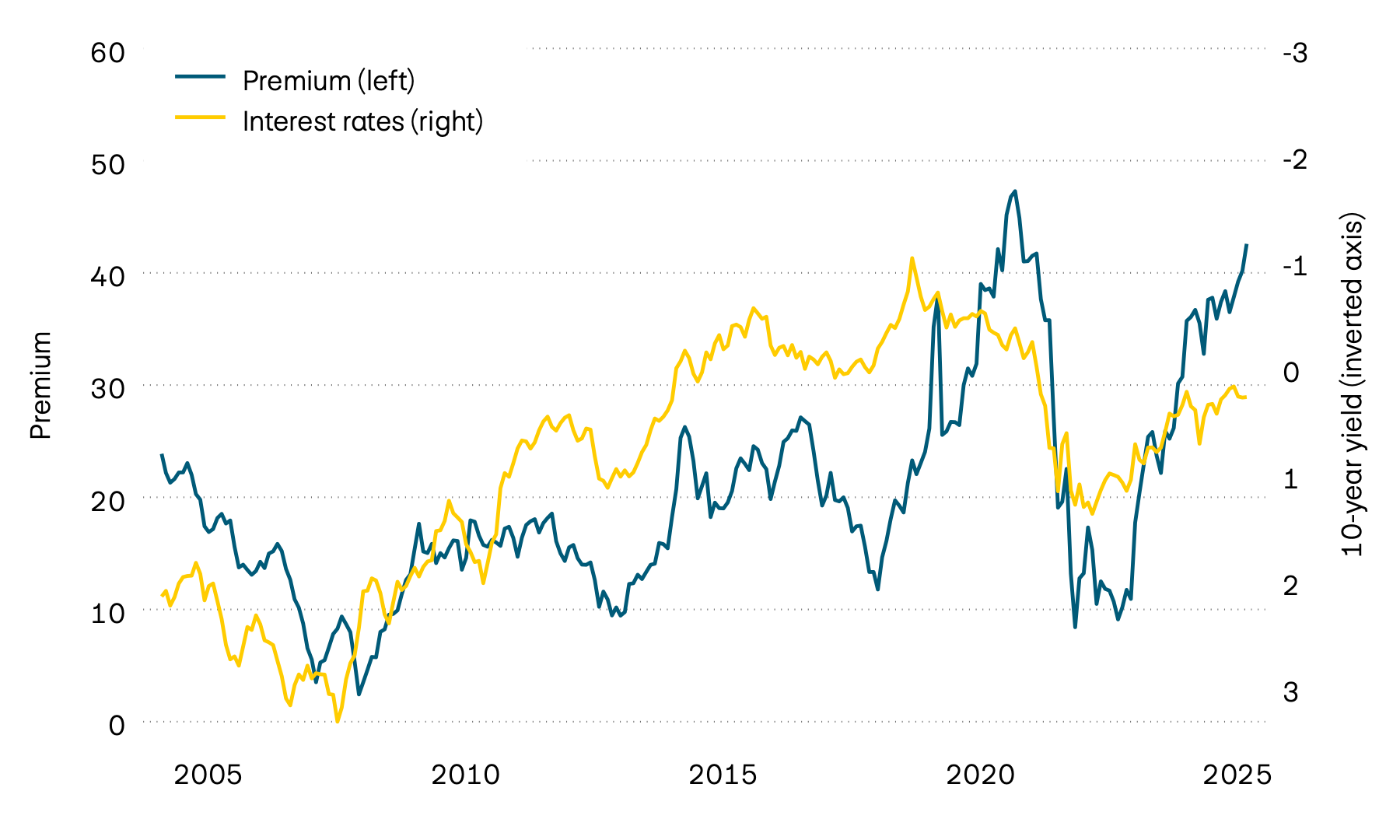

Premium on Swiss real estate funds and 10-year yields to maturity

In percent

The upward trend in the premium paid on investments in exchange-listed real estate funds compared to the net asset value of the underlying properties continued last month. Measured against the current interest rate level, which is close to zero, the premium is now close to historic highs. The last time higher values were seen was shortly after the COVID-19 pandemic. However, given the continuing low interest rate environment in Switzerland, demand for real estate funds is likely to remain strong for the time being.

Three-month SARON and 10-year yields to maturity

In percent

At 0.1 percent in January, inflation in Switzerland remained unchanged and could fall further given the weak economic performance in Switzerland. However, market participants do not currently anticipate any further interest rate cut by the Swiss National Bank (SNB). Yields to maturity therefore remain at a low level. Ten-year Swiss government bonds have been trending sideways at a low level of 0.25 percent for over a month, while the three-month Saron is currently just below zero.

Currencies

The rise in the gold price was interrupted by a significant correction. Looking at currencies, the US dollar was again weak, while the Swiss franc continued to appreciate significantly by comparison.

| Currency pair | Price | PPP | Neutral range | Valuation |

|---|---|---|---|---|

| Currency pair EUR/CHF |

Price 0.92 |

PPP 0.91 |

Neutral range 0.84 – 0.98 |

Valuation Euro neutral |

| Currency pair USD/CHF |

Price 0.78 |

PPP 0.78 |

Neutral range 0.68 – 0.88 |

Valuation USD neutral |

| Currency pair GBP/CHF |

Price 1.06 |

PPP 1.12 |

Neutral range 0.97 – 1.27 |

Valuation Pound sterling neutral |

| Currency pair JPY/CHF |

Price 0.49 |

PPP 0.83 |

Neutral range 0.67 – 0.99 |

Valuation Yen undervalued |

| Currency pair SEK/CHF |

Price 8.60 |

PPP 9.77 |

Neutral range 8.73 – 10.81 |

Valuation Krona undervalued |

| Currency pair NOK/CHF |

Price 8.01 |

PPP 10.38 |

Neutral range 9.11 – 11.64 |

Valuation Krona undervalued |

| Currency pair EUR/USD |

Price 1.18 |

PPP 1.16 |

Neutral range 1.01 – 1.31 |

Valuation Euro neutral |

| Currency pair USD/JPY |

Price 157.22 |

PPP 94.39 |

Neutral range 71.70 – 117.08 |

Valuation Yen undervalued |

| Currency pair USD/CNY |

Price 6.94 |

PPP 6.37 |

Neutral range 5.87 – 6.86 |

Valuation Renminbi undervalued |

Source: Allfunds Tech Solutions

Last month saw a continuation of the major movements that had recently dominated the currency markets. The Swiss franc appreciated significantly against the US dollar and the euro. The Swiss franc is currently trading at its historically highest level against both currencies. The US dollar not only depreciated against the Swiss franc, but also lost value on a trade-weighted basis. Cryptocurrencies were also on a downward trend. Bitcoin fell below the 70,000 US dollar mark. The Japanese yen has recently been particularly strong against the US dollar. Its value has risen by just under 3 percent in recent days.

Cryptocurrencies

| Cryptocurrency | Price | YTD in USD | Annual high | Annual low |

|---|---|---|---|---|

| Cryptocurrency BITCOIN |

Price 66,207 |

YTD in USD –24.33% |

Annual high 96,942 |

Annual low 62,795 |

| Cryptocurrency ETHEREUM |

Price 1,943 |

YTD in USD –34.52% |

Annual high 3,354 |

Annual low 1,842 |

Source: Allfunds Tech Solutions, Coin Metrics Inc

Gold

In the second half of January, gold continued its sharp rise. However, there was a significant correction at the end of month, when the gold price stabilized at 5,000 US dollars.

Indexed performance of gold in Swiss francs

100 = 01.01.2026

The gold price experienced a record surge in January. The many geopolitical tensions are likely to have contributed significantly to the price increase, with annual returns temporarily exceeding 25 percent. At the end of January, however, there was a major correction of over 15 percent. The correction was likely primarily triggered by many speculative positions in the market. In the meantime, however, the gold price has again stabilized to some extent. At 12 percent, annual returns measured in Swiss francs remain very high and are likely to continue to be bolstered by a weak US dollar.