valid from 15.07.2025

You are here:

Model portfolios – Swiss focus

US dollar on a weak course

The financial markets are proving remarkably robust despite the economic uncertainties. So far, only the US dollar has had a noticeable impact. Since the beginning of the year, the currency has lost around 10 percent on a trade-weighted basis. The previously pronounced overvaluation relative to purchasing power parity has thus been significantly reduced. However, the dollar remains overvalued and has further downside potential. Historically, emerging market equities in particular have benefited from a weak US dollar. Against this backdrop, we are increasing their weighting in the portfolio. At the same time, we are strengthening the gold position, which typically also benefits from a weak US dollar, and hedging it against further dollar depreciation.

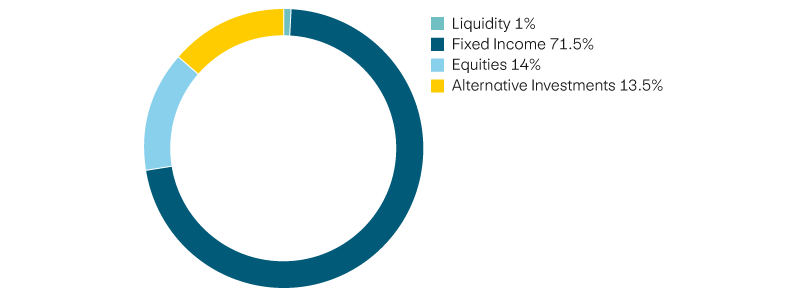

Interest income

Income

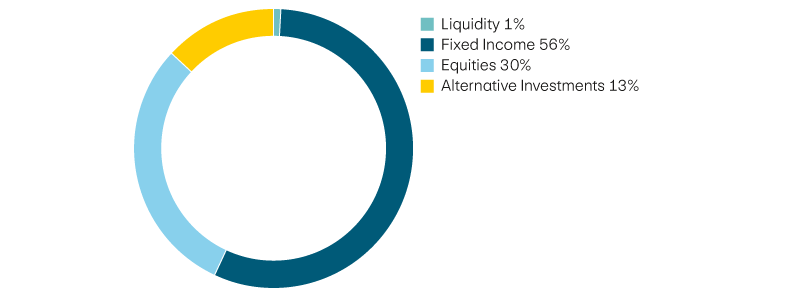

Balanced

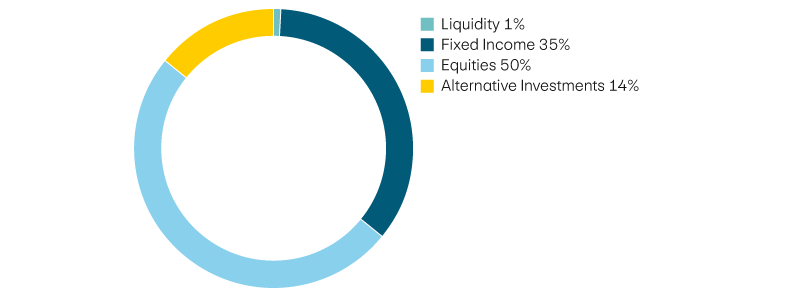

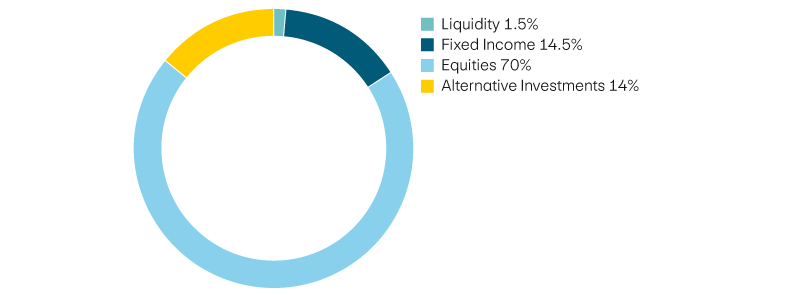

Growth

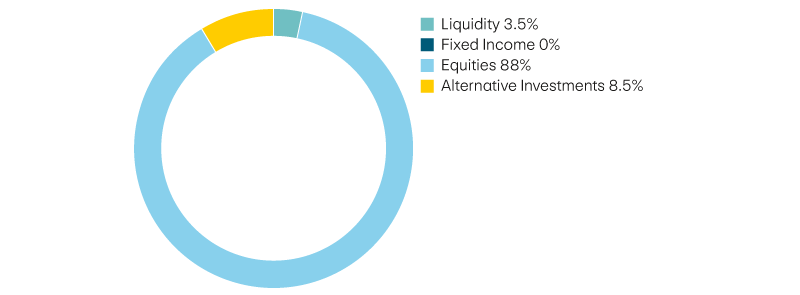

Capital gains