The Swiss export economy remains under pressure. In the fourth quarter of 2025, company exports were a further 4 percent down over the previous quarter, which had already seen a significant decline. This trend is driven primarily by the high US tariffs in place and the ongoing economic downturn in Germany. Given that foreign trade accounts for around 40 percent of Swiss value added, the economy as a whole is likely to have suffered another substantial setback at the end of the year, with its consequences reflected in a slight increase in the unemployment rate. To make matters more difficult, the recent significant appreciation of the Swiss franc could put pressure on the Swiss National Bank (SNB) to again intervene more firmly in the foreign exchange market, or to again introduce negative interest rates. On a positive note, the domestic economy continues to be robust.

You are here:

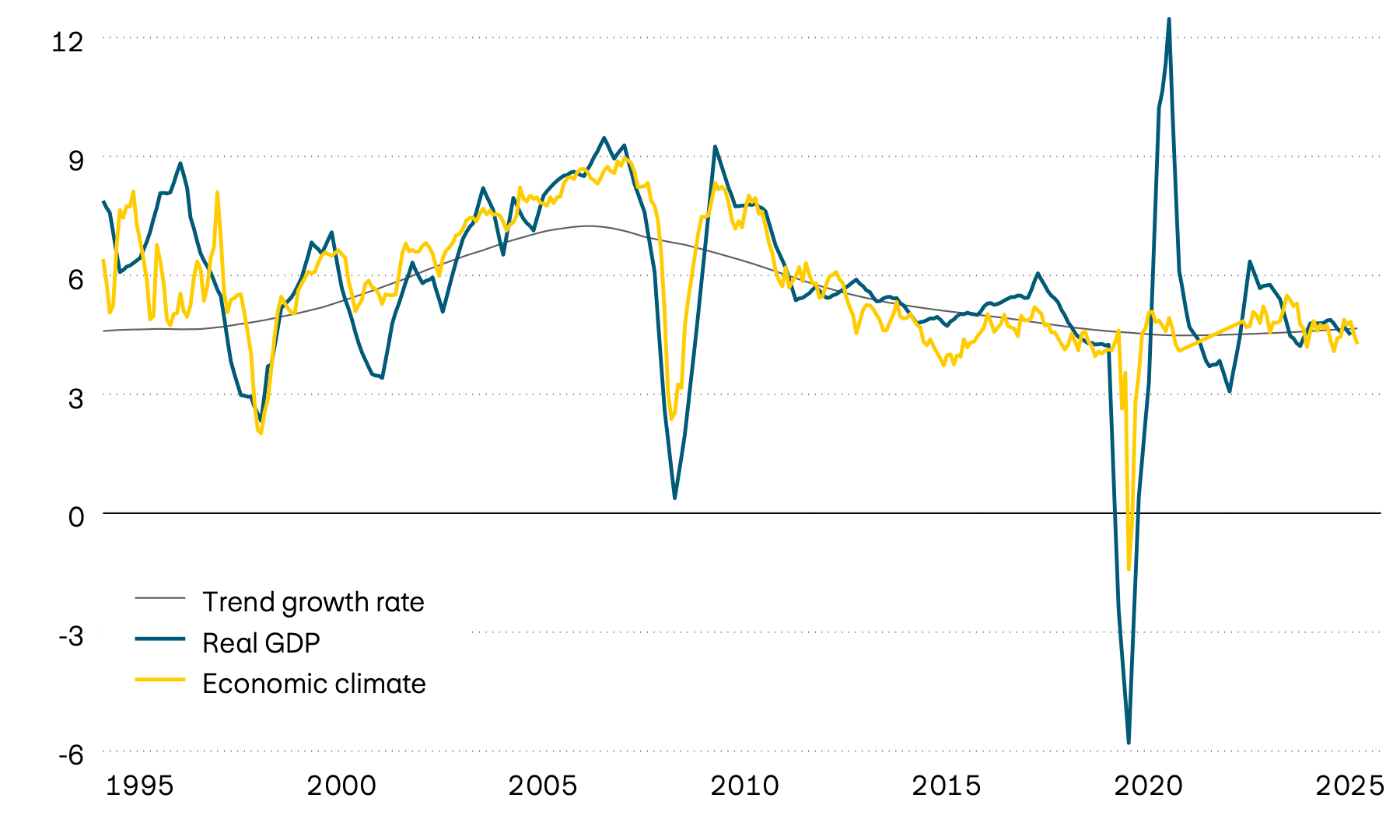

Economy: Hopes of bottoming out

Sentiment among industrial companies around the world improved slightly in January. Although companies in many countries still expect a decline in their business activities, the pace of decline continues to slow. Together with encouraging production figures, this suggests that the global industrial sector is gradually bottoming out. Stabilization of this kind would be urgently needed, in particular for the Swiss economy, which is being seriously impacted by the difficult conditions for export-oriented industry, with effects that are now also being felt on the labour market.

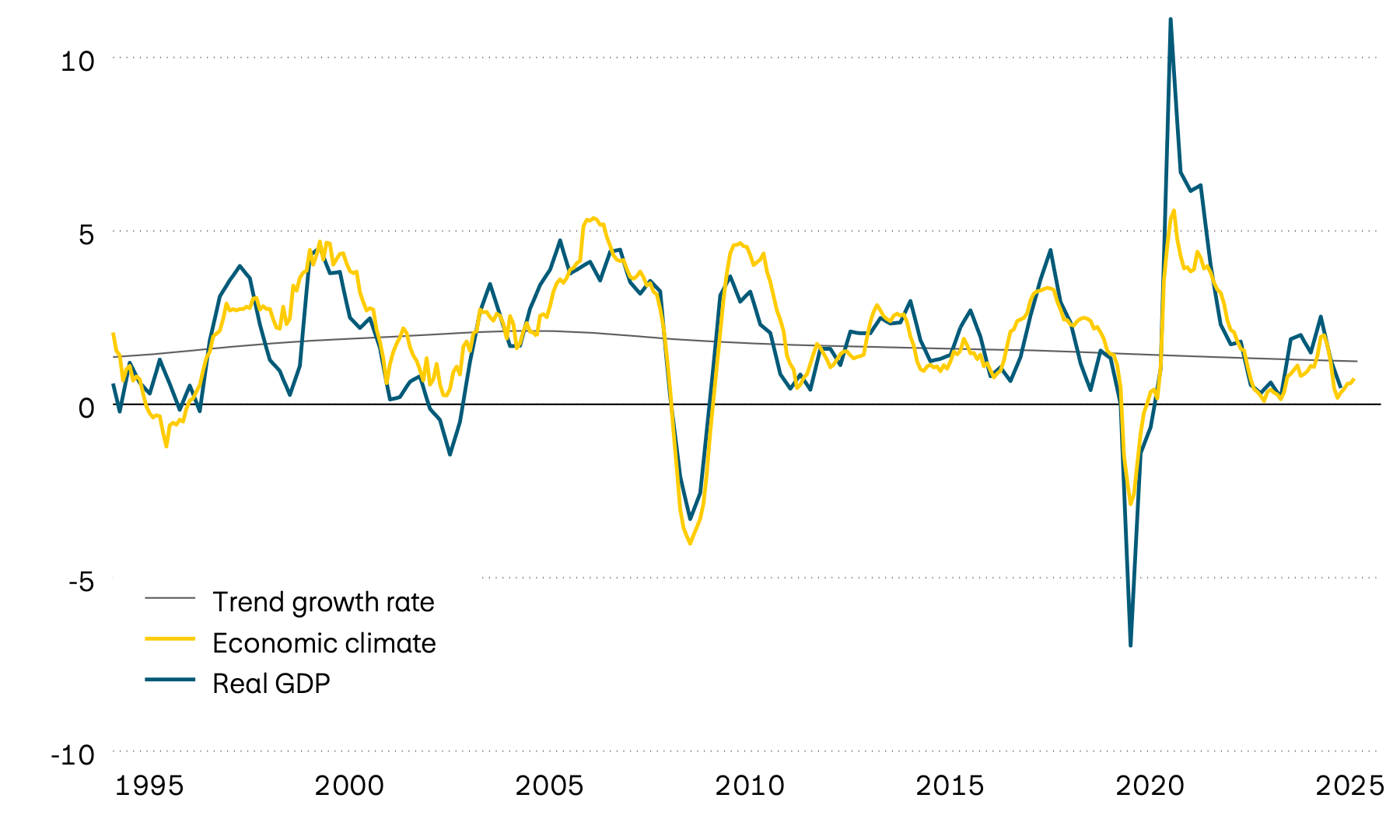

Growth, sentiment and trend

In percent

In the USA, sentiment among industrial companies improved considerably at the beginning of the year. For the first time in a year, companies are expecting to see an increase in their business activities. This is likely due to a slight shift away from foreign goods and towards domestic production, as suggested by declining import figures. It represents the first sign that US policies geared towards bolstering domestic industry are now having their intended effect, although the side effects of higher production costs are likely to be reflected in lower company margins or higher inflation. Despite this improvement, the economic environment remains difficult. Construction activity remains extremely weak and, as incomes have been lagging significantly behind spending for some time now, there is growing uncertainty regarding consumption.

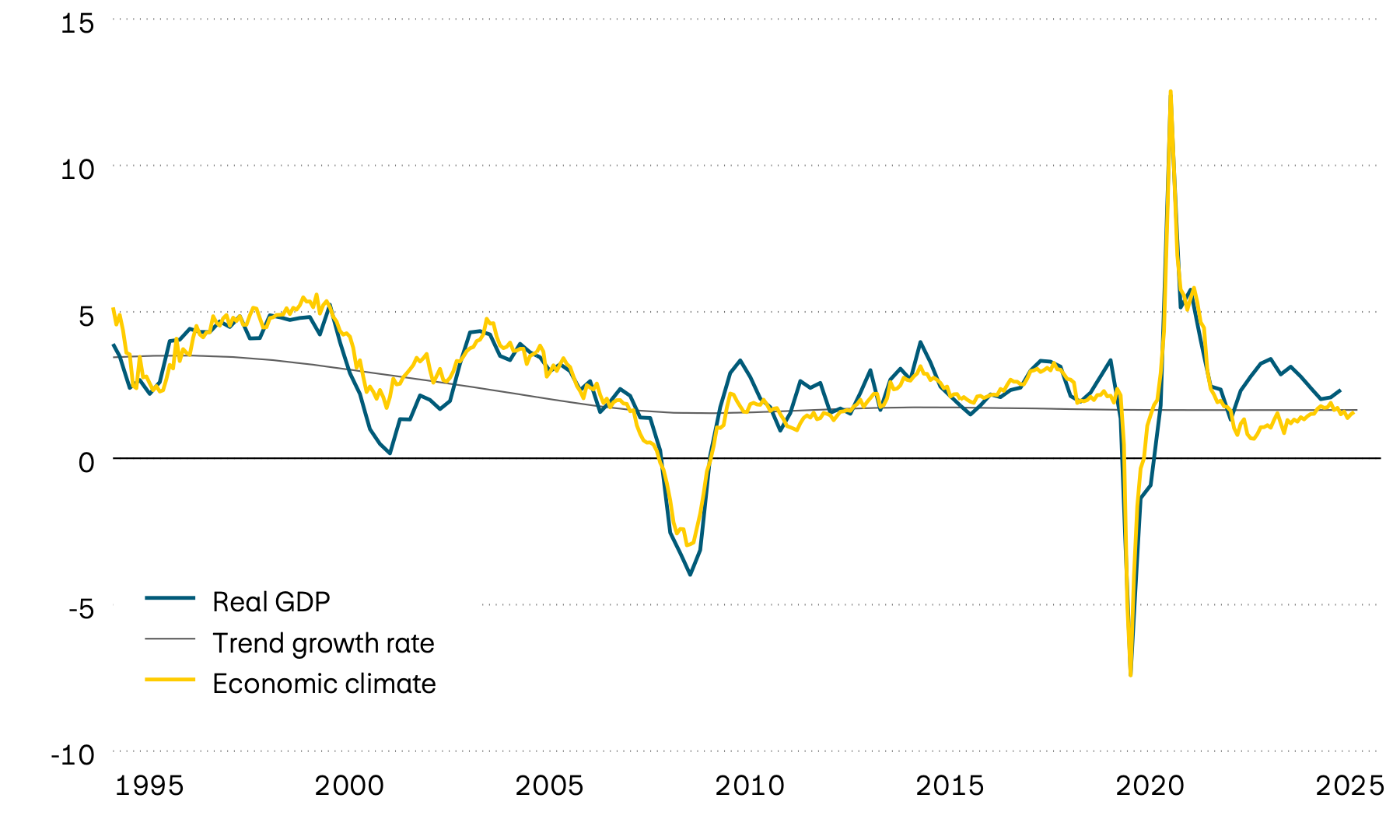

Growth, sentiment and trend

In percent

In the currency area as a whole, the economy grew again by 0.3 percent in the fourth quarter, taking annual growth to 1.3 percent. Spain has been making an important contribution for some time now, with its economic output again seeing a strong rise of 0.8 percent in the fourth quarter. Germany is also showing initial signs of recovery. Following several weak quarters, the eurozone’s largest economy grew by 0.3 percent to achieve annual growth of 0.4 percent. Adjusted for Germany, the eurozone’s expansion would be close to its long-term trend. In addition, the massive fiscal programmes in place in Germany and the eurozone as a whole are likely to gradually take effect, and this should further bolster economic performance.

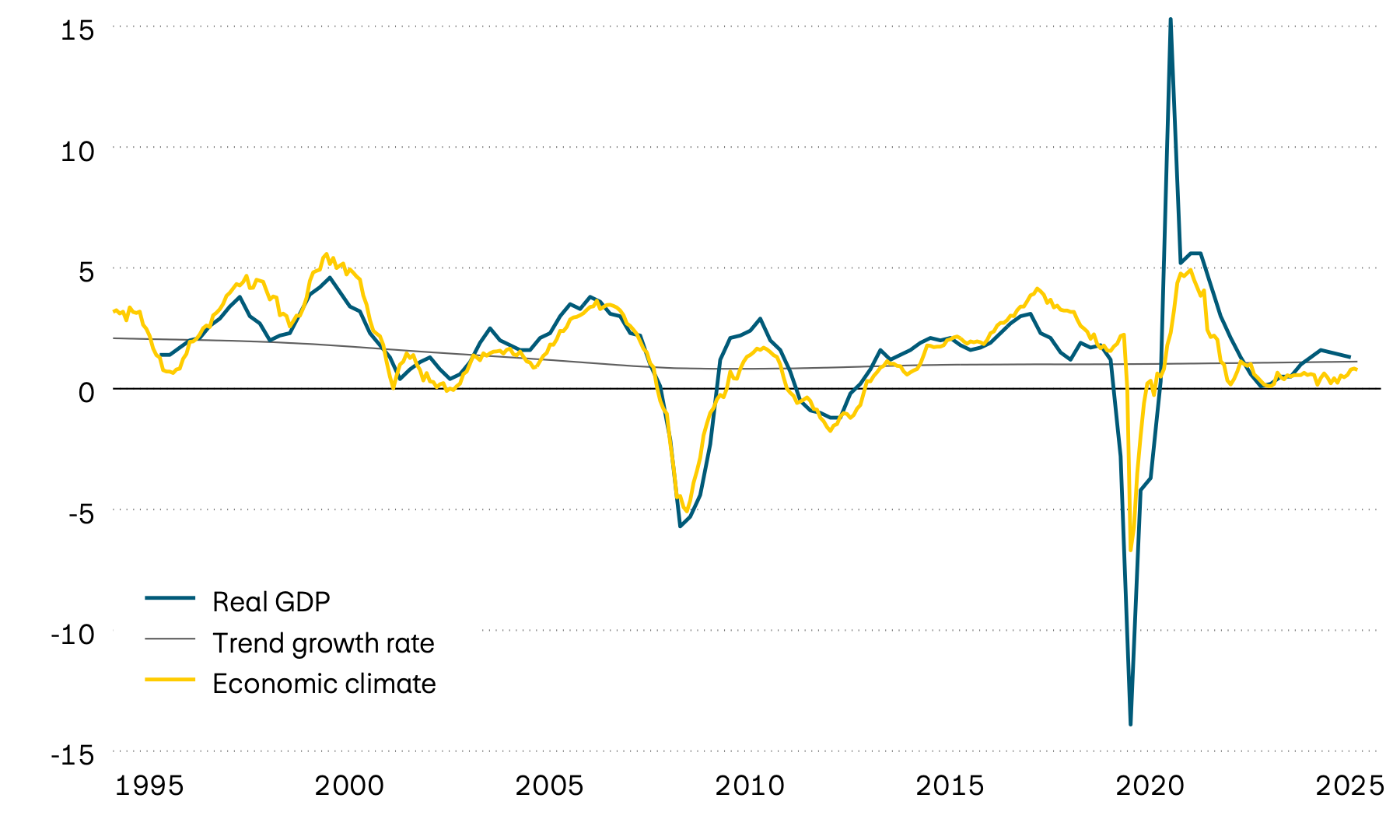

Growth, sentiment and trend

In percent

The downturn in China, by far the largest emerging market economy, has recently intensified. Retail sales are now growing by just 0.9 percent, and investment in construction and equipment is no less than 3.8 percent below the previous year’s figure. Given that this investment accounts for around a third of total economic output, the Chinese government’s reported growth figures of 4.5 percent for the economy as a whole should be interpreted more as a political target than as any reflection of actual economic activity. India, the second-largest emerging market economy, also suffered a slight setback recently. Although business sentiment has weakened significantly, it remains at a high level and continues to indicate strong growth.

Growth, sentiment and trend

In percent

Global economic data

| Indicators | Switzerland | USA | Eurozone | UK | Japan | India | Brazil | China |

|---|---|---|---|---|---|---|---|---|

| Indicators GDP Y/Y 2025Q4 |

Switzerland n/a |

USA n/a |

Eurozone 1.3% |

UK 1.0% |

Japan n/a |

India n/a |

Brazil n/a |

China 4.5% |

| Indicators GDP Y/Y 2025Q3 |

Switzerland 0.5% |

USA 2.3% |

Eurozone 1.4% |

UK 1.2% |

Japan 0.7% |

India 8.2% |

Brazil 1.8% |

China 4.8% |

| Indicators Economic climate |

Switzerland + |

USA = |

Eurozone – |

UK = |

Japan + |

India – |

Brazil – |

China − |

| Indicators Trend growth |

Switzerland 1.2% |

USA 1.7% |

Eurozone 0.8% |

UK 1.8% |

Japan 1.1% |

India 5.3% |

Brazil 1.9% |

China 3.6% |

| Indicators Inflation |

Switzerland 0.1% |

USA 2.4% |

Eurozone 1.7% |

UK 3.0% |

Japan 1.5% |

India 2.8% |

Brazil 4.4% |

China 0.2% |

| Indicators Policy rates |

Switzerland 0.0% |

USA 3.75% |

Eurozone 2.15% |

UK 3.75% |

Japan 0.75% |

India 5.25% |

Brazil 15.0% |

China 3.0% |

Source: Bloomberg