At a glance

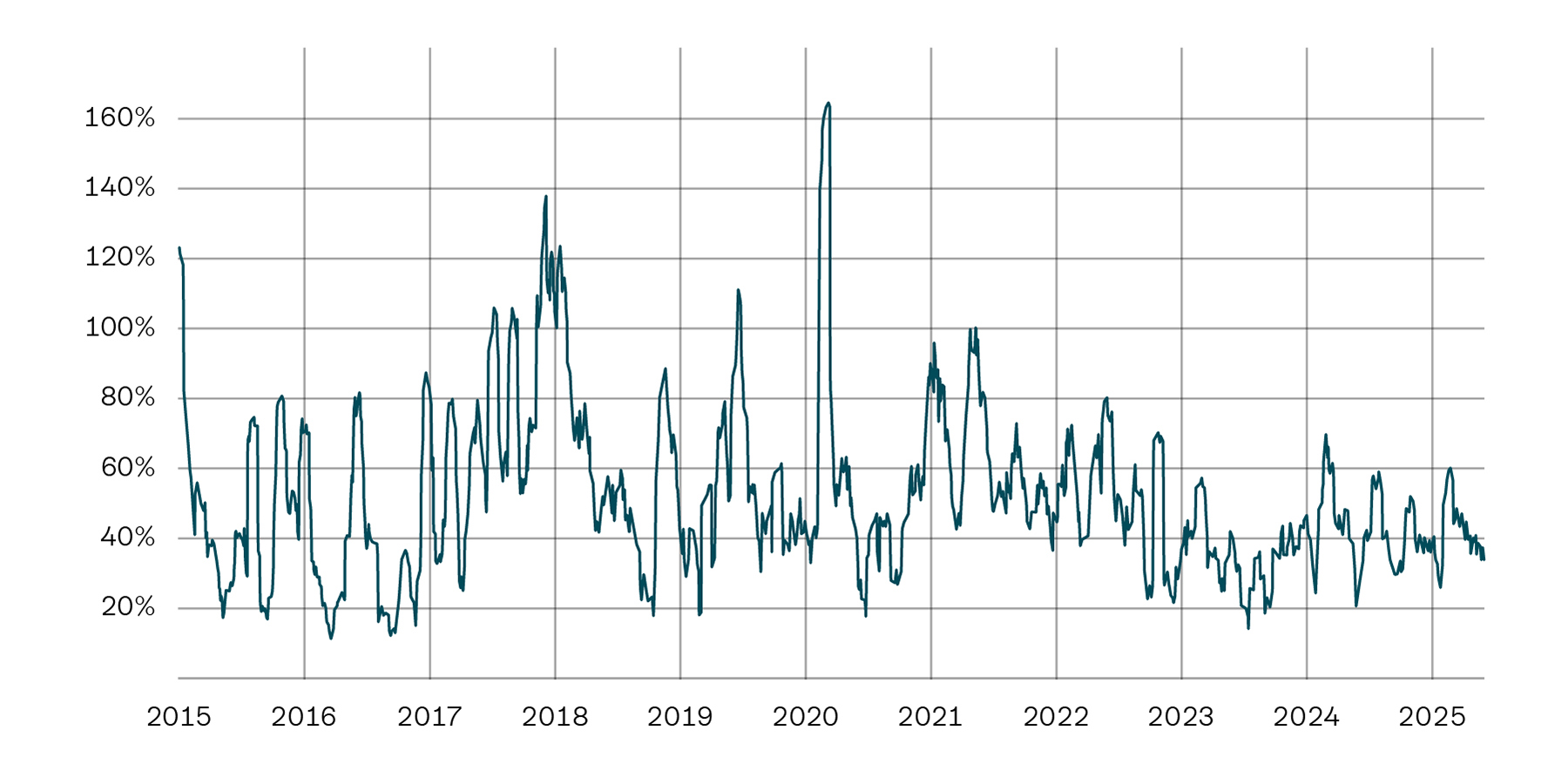

- Volatility illustrates how sharply prices fluctuate over time and helps to better assess risks and opportunities.

- Bitcoin and other cryptos usually have greater price fluctuations than gold or shares. This is due to market structure, liquidity and trading times.

- Declining volatility for established cryptocurrencies such as Bitcoin indicates increasing market readiness, though price fluctuations won’t disappear.

Receive regular updates, background information and tips on cryptocurrencies with our investment newsletter.