At a glance

- DeFi is an open financial system where technology removes the need for trust. Smart contracts perform tasks that were previously performed by banks.

- Using them requires individual responsibility: anyone using DeFi applications holds their own assets in custody and bears the risk of errors, hacks or price losses.

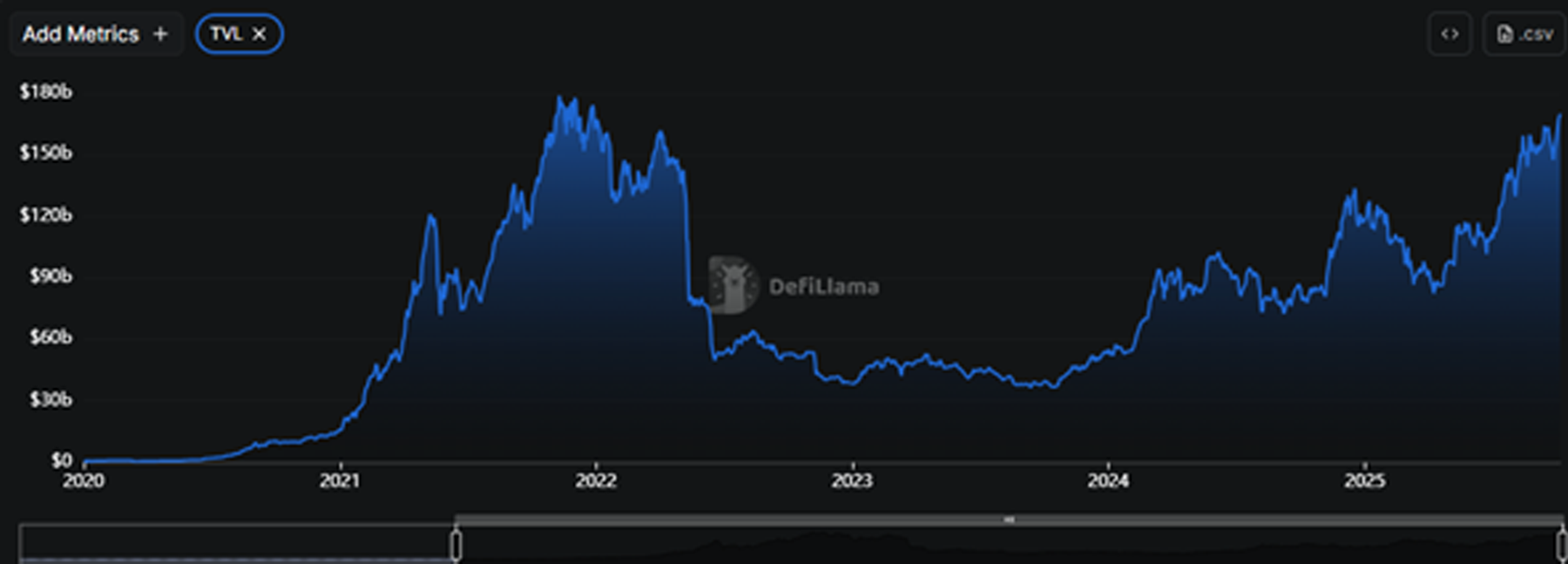

- DeFi is developing dynamically: more and more capital is flowing into the market, and traditional financial service providers are also looking into how to integrate DeFi components in a secure, regulated manner.

Understanding cryptocurrencies, seizing opportunities: get valuable insights into crypto‑investment options – subscribe now to our investment newsletter.