When you hear the words “private retirement planning 3a”, is the first thing you think of a classic 3a account solution or 3a life insurance? There are alternatives that will boost your chances of increasing your savings over the years.

With a 3a account, you have the option of paying interest on your contributions as a savings deposit, although interest rates have been low for quite some time now. Alternatively, in just a few steps you can invest the retirement capital from your 3a account into retirement funds so that you can benefit from the opportunities of the capital markets in the long term. Seeing as the investment horizon for retirement assets tends to be long-term, you could take more of a risk, which may well be rewarded with higher potential returns. Additionally, price fluctuations even out more over a longer period of time. Find out more about the differences between a retirement savings account and a retirement fund in our article “How to get more from your retirement planning”.

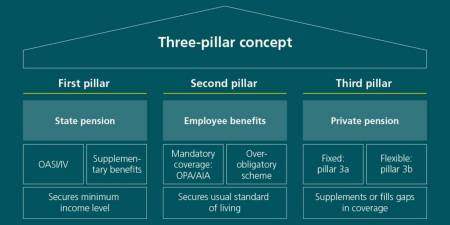

In the case of 3a life insurance, you can opt for the classic products with guaranteed benefits, or you can choose to invest in retirement funds here as well.

Are you aware of the benefits of a retirement fund, but still unsure which fund is best suited to your needs? A key USP is the equity component of a fund. Read more in our article “What is the right retirement fund for you? It is well worth comparing them!”