At a glance

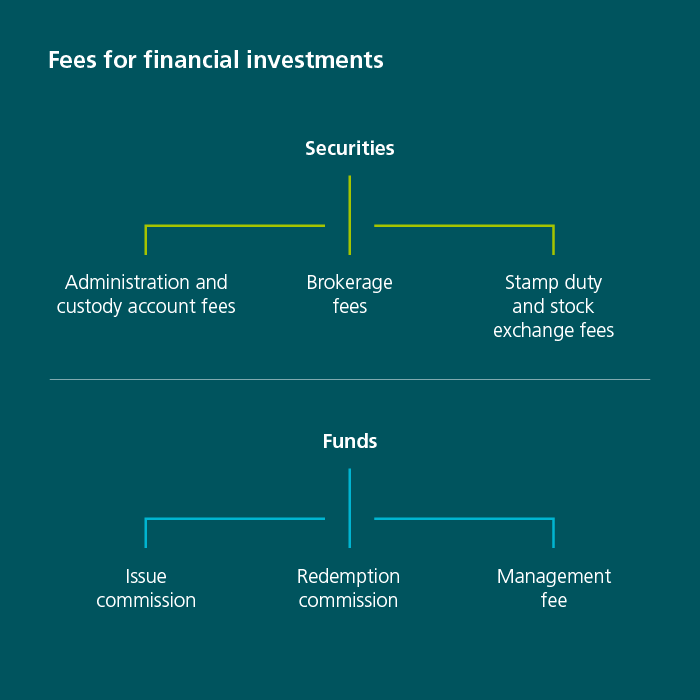

- When it comes to financial investments, there are various costs that can affect the return. These include custody account fees, brokerage fees and management fees, which vary by provider.

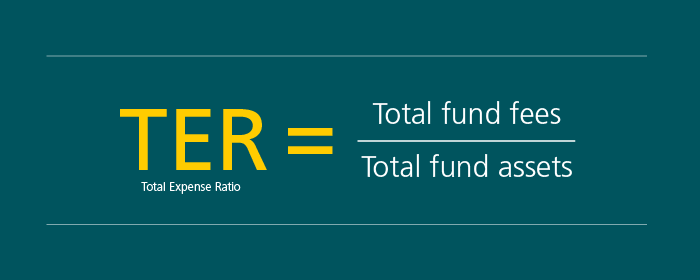

- In addition to direct fees such as issue commission, fund investors must also consider indirect costs such as the total expense ratio (TER), which represents the management costs for the fund.

- It is worth comparing fees and costs carefully, as they can have a major impact on your return over the long term.

Keep up to date on financial investments. Subscribe to our investment newsletter for regular updates.