At a glance

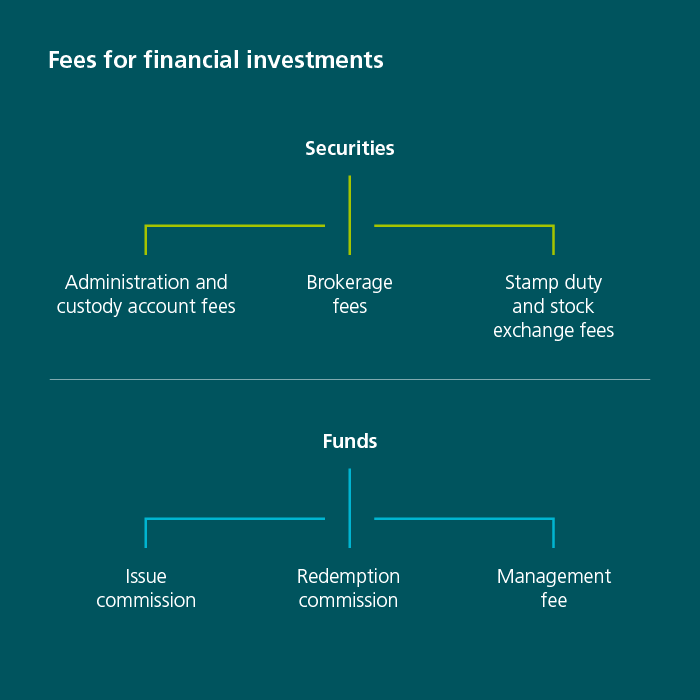

- When it comes to financial investments, there are various costs that can affect the return. These include custody account fees, brokerage fees and management fees, which vary by provider.

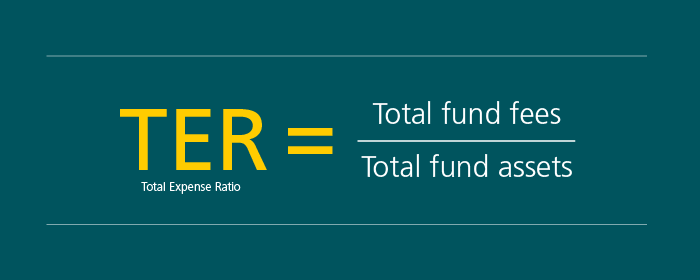

- In addition to direct fees such as issue commission, fund investors must also consider indirect costs such as the total expense ratio (TER) or ongoing costs, which represents the management costs for the fund.

- It is worth comparing fees and costs carefully, as they can have a major impact on your return over the long term.

Keep up to date on financial investments. Subscribe to our investment newsletter for regular updates.