valid from 17.02.2026

You are here:

Model portfolios – Swiss focus

Value stocks continue to impress

After a good start to the year, momentum on the stock markets has slowed. The US stock markets in particular have been noticeably weaker. This is largely due to the increased focus on the winners and losers of the AI euphoria, from which the technology-heavy US stock market in particular has benefited greatly over the past two years. Investors seem to be taking a closer look at who will actually be among the winners in the race for artificial intelligence, because there cannot be only winners. Against this backdrop, we have been cautious about the highly concentrated US stock market for some time, particularly in view of the previously undifferentiated assessment of AI euphoria. Instead, we have continued to favour global value stocks. This has clearly paid off this year. We continue to see upside potential and are therefore maintaining this positioning and our overall orientation unchanged.

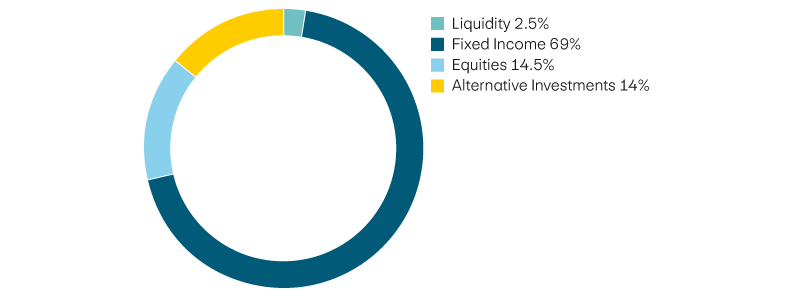

Interest income

Income

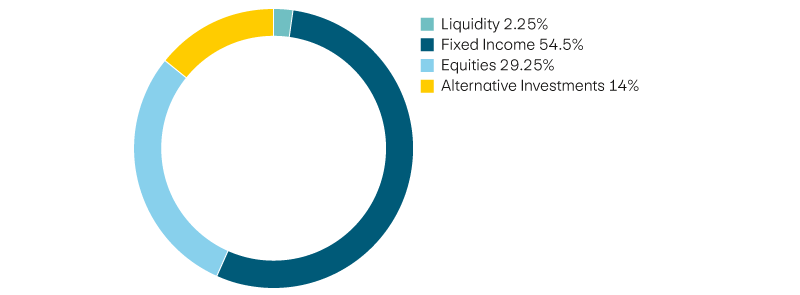

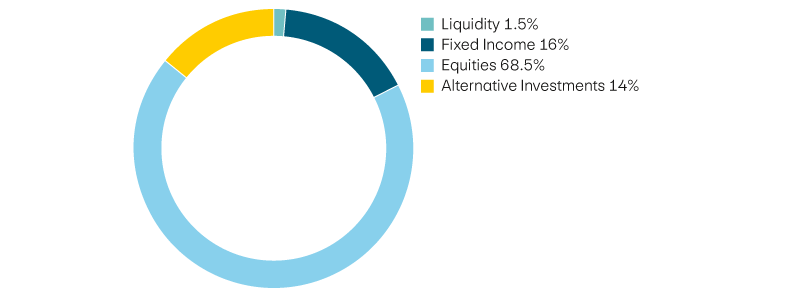

Balanced

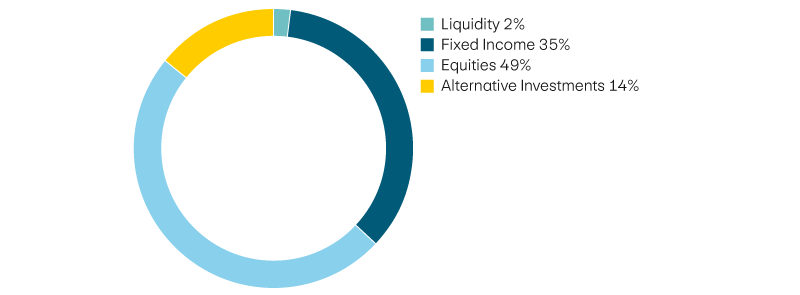

Growth

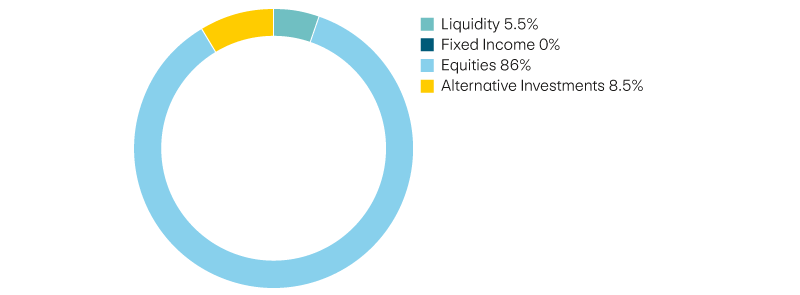

Capital gains