The compound interest effect can explain how little sums become big sums quicker than expected. Indeed, it can even be worth investing small sums in an investment fund. This means you’ll have the prospect of returns that are significantly higher than the interest on a savings account — and you’ll benefit from the compound interest effect as well.

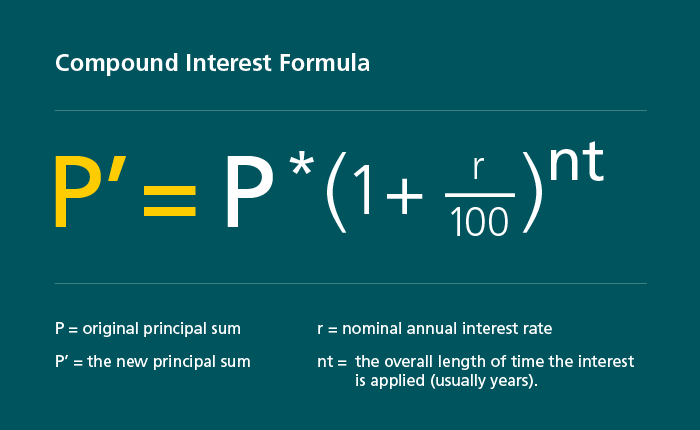

Compound interest ensures that the amount saved or invested as initial capital, as well as monthly or annual investments, increase at a disproportionately high rate. This compound interest effect is based on the principle that the longer the term of a financial investment, the stronger it gets. This may all sound complicated, but it is in fact a very simple principle. If you re-invest interest (or returns) from an investment, you will accrue further interest/returns. The longer you spend investing these returns based on this principle, the greater the compound interest effect. Still sound complicated? Watch how passers-by in the street reacted when we asked them to explain compound interest.