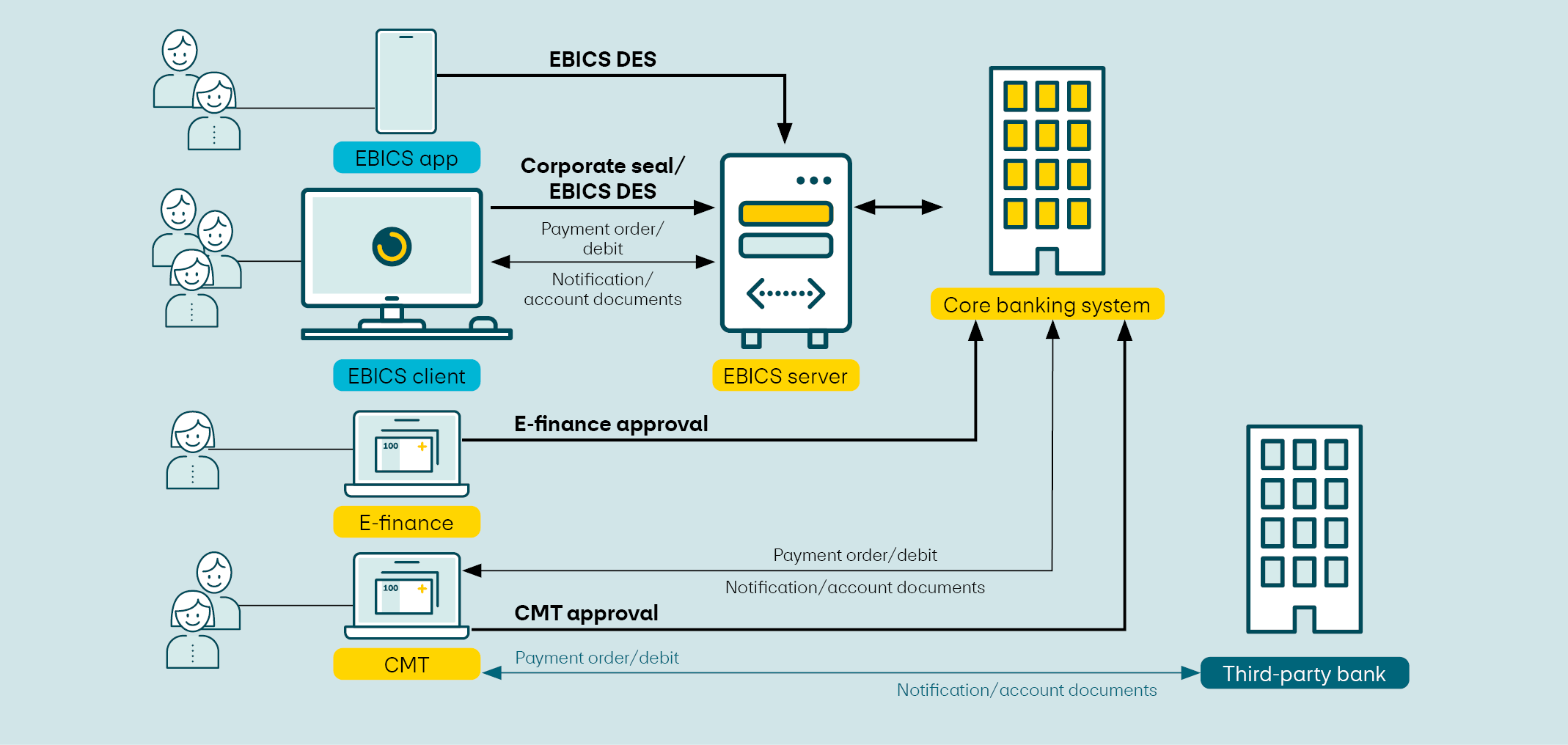

The EBICS interface from PostFinance is your updated, faster and more secure communication method that ensures electronic access to your payment transactions and cash management.

EBICS (Electronic Banking Internet Communication Standard) is a European standard for automatic data exchange that allows you to carry out payment transactions highly efficiently.

Typical EBICS features are the high degree of security through the use of hash values, encryption and electronic signatures and the mapping of different authorization structures using a “distributed electronic signature”. A core added value compared to other technical channels is data exchange regardless of country. This functions via a single EBICS connection with all financial institutions that offer EBICS. Messages and reports are known as “order types” in the EBICS environment.