You apply for an account overdraft limit, which is based on the average revenue in your PostFinance business account. The higher your business revenue, the higher your possible overdraft limit – up to a maximum of CHF 20,000.

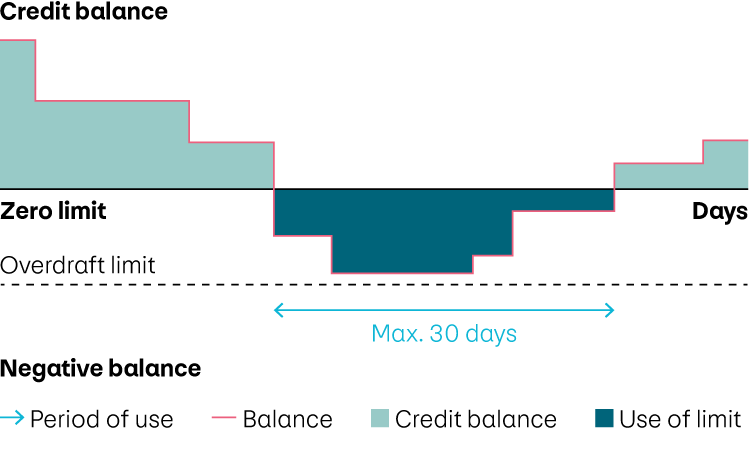

Once the check has been successfully completed, the agreement will be concluded and the overdraft limit on your business account will be suspended. Up to the defined limit, you may overdraw the business account for a maximum of 30 days in a row. The business account must have a positive balance after 30 days at the latest or once a month.