Download documents yourself in e-finance

Below you will find a guide on how to download these in e-finance or in the PostFinance App.

Do you need account statements, or are you missing specific documents for your tax return? You can download these directly in e-finance or the PostFinance App.

Below you will find a guide on how to download these in e-finance or in the PostFinance App.

Are you looking for a bank statement from 2018 onwards? Download your account documents directly in e-finance.

Are you completing your tax return and need last year’s account documents? Download your documents directly in e-finance.

Find out here when the tax documents will be available.

| Document | |

|---|---|

| Document Tax documents for private and savings accounts private and savings accounts Tax documents for private and savings accounts business and association accounts |

2 January 2026 Customers without e-finance will receive the tax documents by post by 16 January 2026. |

| Document Tax certificate and account statement for 3a retirement savings accounts. |

Mid-January 2026 |

| Document Tax documents for investment products e-asset management and investment consulting plus |

End of February 2026 The electronic tax statement is free of charge. |

| Document Tax documents for the products fund self-service and fund consulting basic |

End of February 2026 Customers with e-finance receive a free electronic tax statement in e-finance.

Customers without e-finance receive a free tax statement by post. |

| Document Tax certificates for mortgages |

15 January 2026 Customers without e-finance receive their tax certificates by post. |

With electronic tax statements (e-tax statements) for investment products, the content of the tax statement is displayed in a standardized digital format. This makes it possible to upload the e-tax statement in the cantonal tax declaration solution.

The electronic tax statement contains the same information as the physical tax statement.

Do you already receive your account statements, interest statements and tax documents in digital format?

Would you like to be notified as soon as your new tax documents are available? Watch the video tutorial and activate the “Tax documents” push notification in the PostFinance App. Alternatively, you can also activate it in e-finance in the settings under “Notifications” and select both e-mail and push notifications as the delivery type.

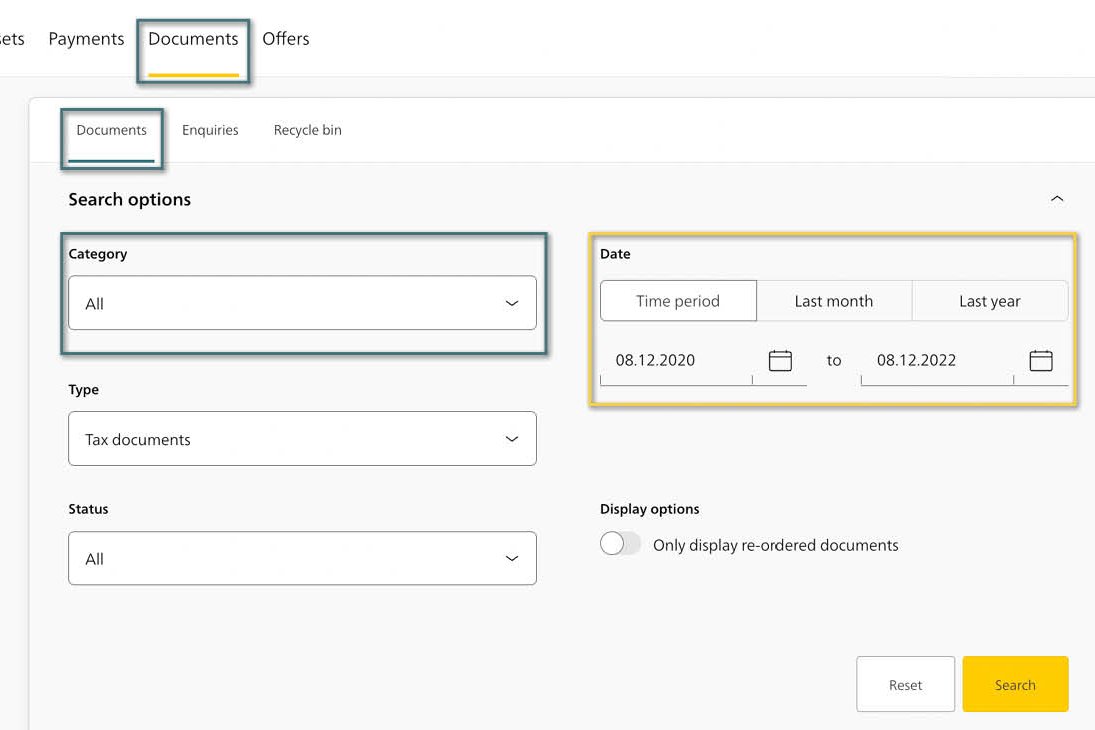

Are you an e-finance customer and already logged in? You can find all your available documents in the main menu under “Documents”. Using the search options, you can find the documents you want quickly and efficiently.

Do your need your tax documents? Below you will find a guide on the quickest way to find these.

Would you like to download or print your account documents in the PostFinance App? Log in to the app and click on the “More” button in the bottom right. Under Services, you will find your “Documents”. To print or sent the document from your smartphone, open the document, and then select the icon displayed in the top right.

If the document is more than two years old, you will need to reorder it. To do this, log in and select “More” > “Documents” > “Order”. Reordering electronic documents is free of charge.

Do your need your tax documents? Then filter your search using the “magnifying glass” in the top right by selecting “Taxes” and confirming by clicking on “Search”.

With the e-tax statement, you can transfer the necessary information from e-trading to your Canton of residence’s tax software in just a few clicks. The e-tax statement costs 97.30 francs (incl. VAT). You can order it directly in e-trading under “Documents”.

You will receive the statement in e-trading under “Documents” from the end of February. E-tax statements from previous years (2024 or earlier) are available to you within 10 working days.

Find out more about tax on shares in our blog article “Paying tax on shares in Switzerland”.

Do you need account documents from before 2018 or bank statements for a particular period? Would you like to reorder an electronic document on paper? |

Order your bank statement for a time period of your choice up to 10 years in the past. Orders in e-finance are free of charge. Delivery by post is subject to a fee. |

You can reorder interest statements for up to ten years. Electronic orders in e-finance are free of charge. Reorders on paper are subject to a charge. |

Are you a business customer? Please contact us to reorder your documents.

Contact us to order the desired document over the phone.