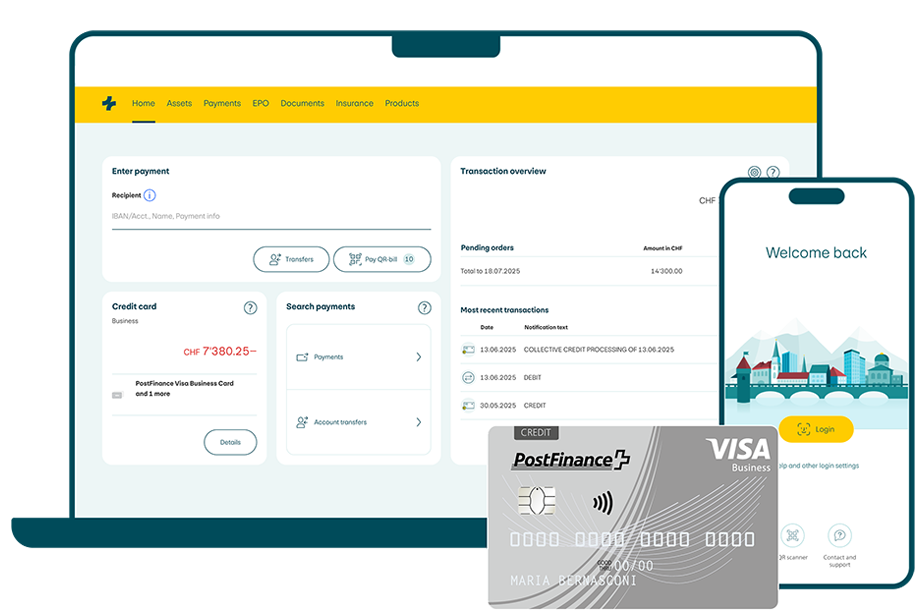

The PostFinance Visa Business Card is the ideal solution for your business expenses in Switzerland and abroad and for simple expense management. Manage your card easily online and keep an eye on your company finances.

Costs: CHF 80/year per card

Your company credit card for travel and expenses

Ideal for worldwide business spending: with our PostFinance Visa Business Card company credit card, you can pay securely, quickly and easily – whether online, in Switzerland or abroad. You get money back on all purchases and are well protected when you’re travelling.

Up to 0.6% cashback directly on your business account for every purchase

Individual limits per employee possible

Load credit easily via e-finance

Make secure, fast mobile payments with Apple Pay, Google Pay, PostFinance TWINT, etc.

Comprehensive insurance benefits on business trips

The PostFinance Visa Business Card is the ideal solution for your business expenses in Switzerland and abroad and for simple expense management. Manage your card easily online and keep an eye on your company finances.

Costs: CHF 80/year per card

The company is domiciled in Switzerland or Liechtenstein and has a business account in CHF with PostFinance.

Via hotline/customer advisor |

CHF 30 per card |

|---|---|

Via e-finance |

CHF 25 per card |

Monthly spending limit |

Individual |

|---|---|

Transactions abroad incl. online shops of foreign retailers (CHF/foreign currencies) |

1.7% processing surcharge |

Cash withdrawal at ATMs in Switzerland and abroad |

3.5% commission (minimum CHF 10) |

Lottery, betting and casino transactions |

3.5% commission |

Monthly cash withdrawal limit |

|

Monthly invoice payment deadline |

20 days, default interest charged thereafter |

|---|---|

Debit or invoice |

Charged via Swiss Debit Direct, e-bill or with inpayment slip (free of charge in e-finance) |

Annual interest rate in the event of default |

9.5% |

Increase in available amount |

By inpayment to card account |

With unlimited cashback for the business cards from PostFinance, you can benefit from a turnover reimbursement of 0.3%. In the first year you even receive a double bonus. The payment is made directly into your business account every six months, in June and December.

Cashback on the sales turnover achieved :

Pay for at least 51% of your business trips with the PostFinance Visa Business Card and benefit from the integrated insurance benefits – at no added cost.

Thanks to secure e-finance, you have your credit card under control at all times:

Pay securely, more easily and quickly. Save the PostFinance Visa Business Card in Apple Pay, Samsung Pay, Google Pay or SwatchPay and TWINT.

Book your rented vehicle via the link below and pay with your PostFinance Visa Business Card. You will be granted the discount automatically.

The link will open in a new window Book now at avis.ch

Rental vehicles can be booked by calling The link will open in a new window +41 848 811 818. Quote the AWD number (Avis Worldwide Discount number). You can find it on the back of your Business Card.

Debit cards are often not accepted when booking accommodation, rental cars or flights. But a credit card guarantees the reservation.

Make secure payments worldwide with PostFinance credit cards thanks to the latest chip technology and 3-D Secure.

3-D Secure – shop online easily and securely

Make contactless payments with the card

More information about card security

A company credit card enables you to make a clear distinction between business expenses and personal expenses, simplifies accounting and offers employees personal card limits. Companies also benefit from special insurance policies for business trips.

Yes, you get money back every time you pay with your company credit card. Thanks to our bonus programme, you benefit from cashback of up to 0.6 percent. The payment is made directly to your business account in June and December.

Billing can be sent to the company as a monthly batch invoice or to each cardholder as an individual invoice, as required. The credit card invoice must be paid within 20 days. Partial payments are not possible.

There are two ways to flexibly adjust the card limit on your company credit card as required:

you can submit a request to increase the card limit. The limit will be adjusted permanently.

Useful to know: you set a main account limit. This is the maximum amount that can be spent with all PostFinance Visa Business.

If the current limit is not sufficient, in e-finance or the PostFinance App you can add credit to the credit card from your business account in a matter of seconds. You can of course choose the top-up amount, so you can cover last-minute expenses without any problems.

Yes, if you already have a framework agreement (main account) for the PostFinance Visa Business Card, you can order additional business cards using the following form.

The link will open in a new window PostFinance Visa Business Card application (PDF)

The company credit card should only be used to pay for business-related expenses. To ensure a clear distinction is made between expenses, it is advisable to have a credit card for business expenses and one for private expenses.

If company credit cards are issued to employees, a user agreement is advisable. The company defines what employees may – and may not – use the credit card for.

PostFinance company credit cards can be activated for Apple Pay, Google Pay and Samsung Pay, for example, so that you can use them digitally and make mobile payments. Company cards can also be managed via e-finance or the PostFinance App. However, the plastic card will always be delivered. PostFinance does not currently offer a purely virtual company credit card.

For all customers who don’t yet have a business relationship with PostFinance |

For existing business customers who want to apply for a company credit card