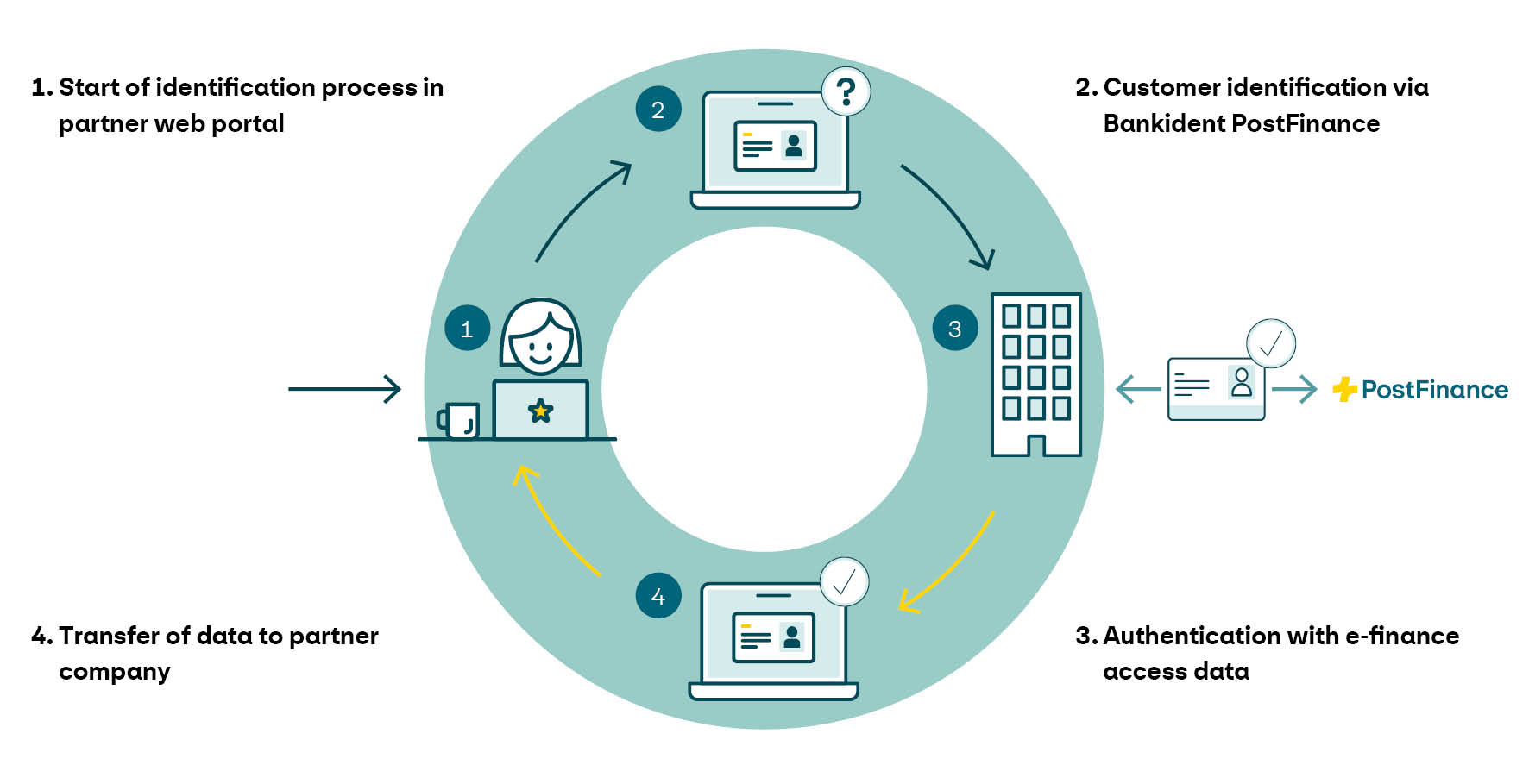

Bankident PostFinance explained in brief

You integrate our solution into your chosen business process (e. g. conclusion of contracts). When it’s time for the identification process, customers switch to their e-finance, accept the transfer of their data and are then returned to your business process straight away. The entire identification process via PostFinance takes approx. 30 seconds. There is no longer any need for video identification.

Bankident PostFinance is suitable for all contract conclusion processes that require the personal identification of the customer (e. g. for mobile providers, insurers, providers of consumer credit, mortgage providers, investment advisors and other financial intermediaries subject to the AMLA).