Preconditions

- All participating companies must be domiciled in Switzerland

- At least 3 business accounts in CHF or EUR

- Pooling requires accounts to be in the same currency

Cash management optimization

With pooling, your company’s business accounts – including subsidiaries and branches – are considered collectively in terms of liquidity. Thanks to our pooling options, you can achieve higher interest income and lower external financing.

The liquid assets of a group or a company are grouped together

Simplified liquidity management

Simplified payment transactions

Overview of the liquidity of a group or a company

Pooling options to meet individual requirements

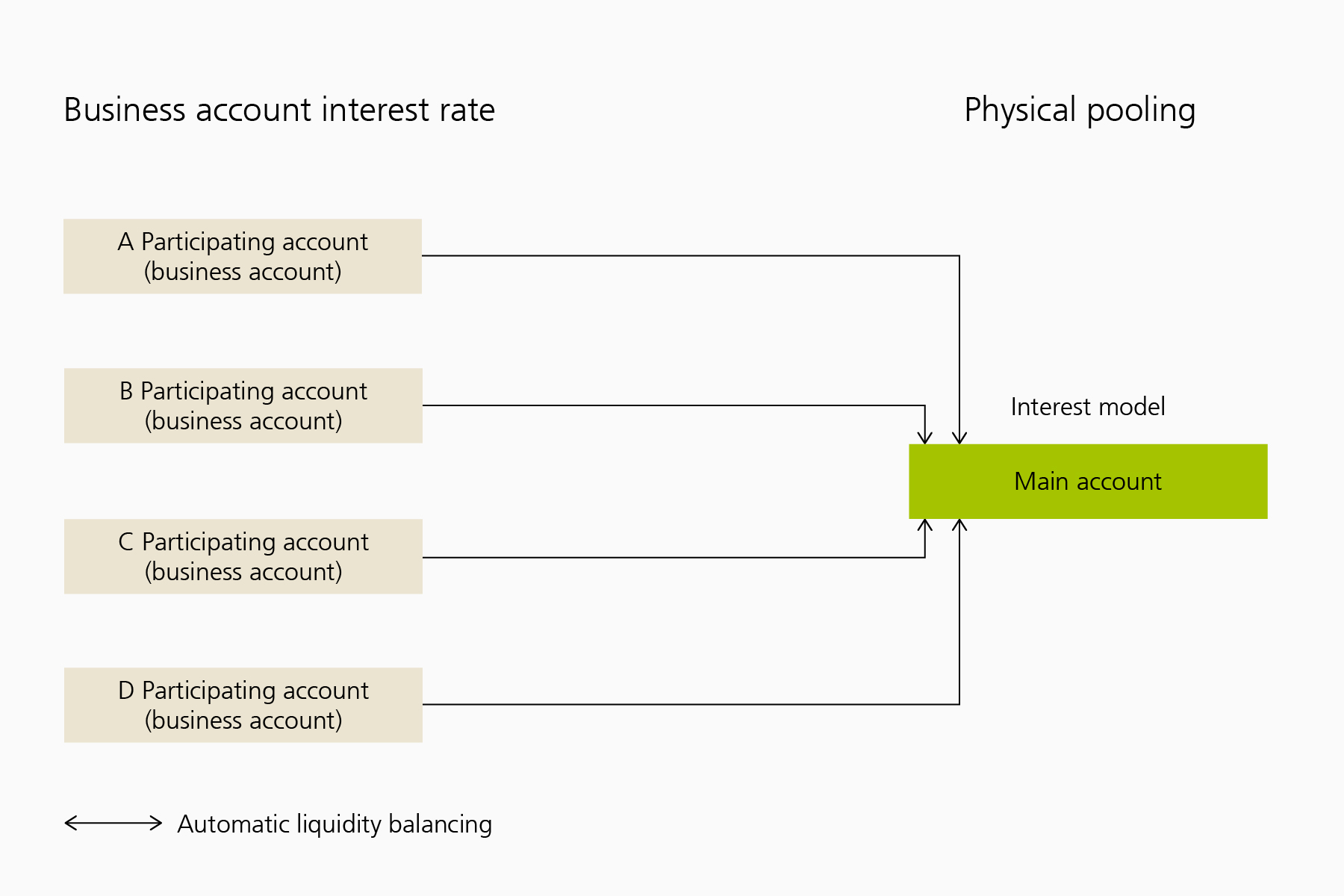

With physical pooling, your balances are actually transferred from the participating accounts to the main account and vice versa. Each participating account earns its own interest and receives a separate interest statement.

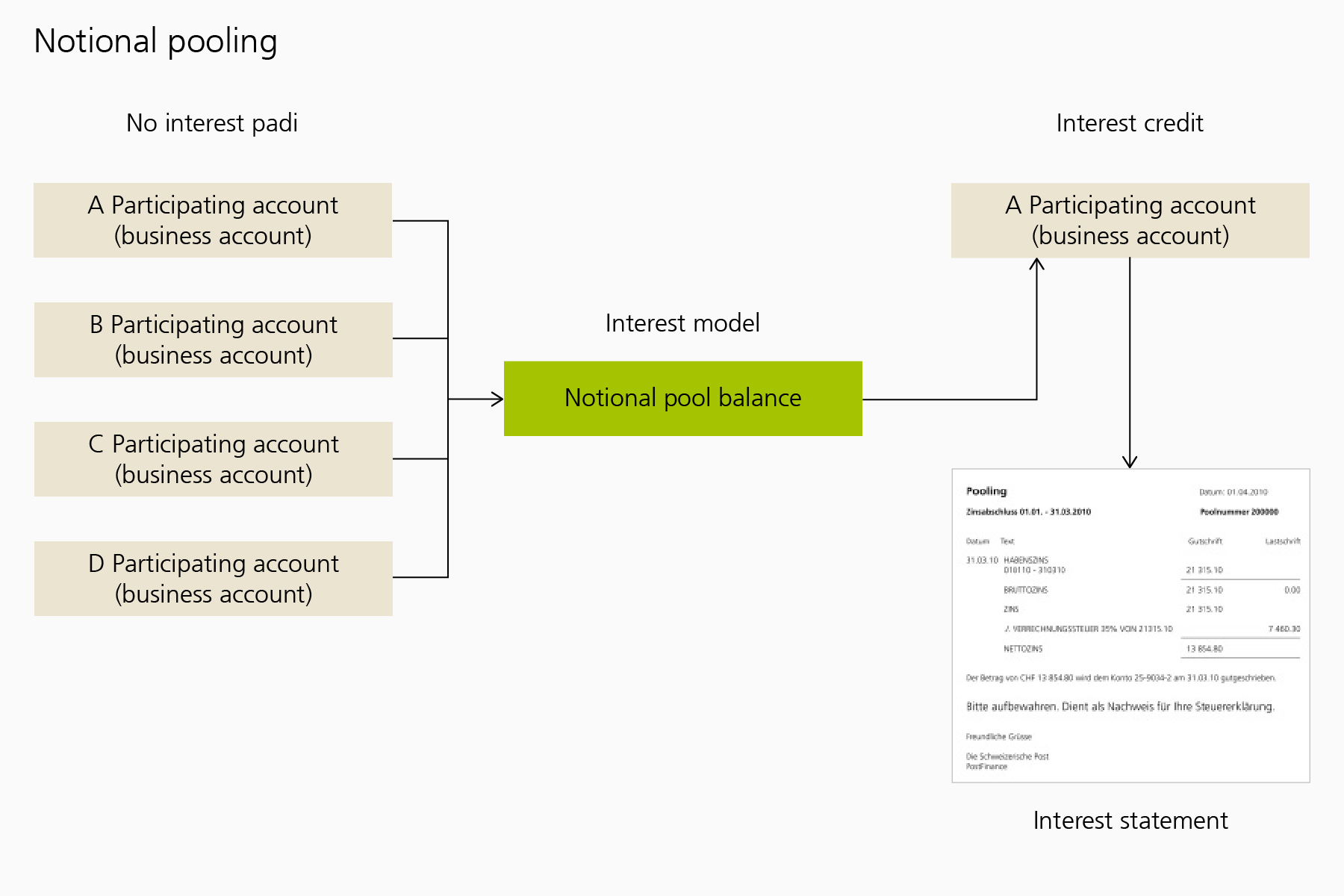

With notional pooling, the participating account balances are consolidated into one virtual pool balance. This pool balance is used as the basis for calculating interest.

The prices for pooling comprise an activation charge and a monthly fee. Charges depend on the pooling structure and on the number of participating accounts.