You are here:

Useful information about the QR-bill

Here you will find answers to the most frequently asked questions about creating, designing and paying the QR-bill.

Basic information about the QR-bill

-

There are three types of QR-bill:

QR-bills with a QR-IBAN and QR reference

The QR reference consists of 26 numerical characters, followed by a check digit. It meets the Swiss standard and can only be used on QR-bills for domestic payments (in Switzerland and Liechtenstein). The reference cannot solely be made up of zeroes.QR-bill with an IBAN and without a reference

QR-bill with an IBAN and a Creditor Reference

The Creditor Reference (also known as “Structured Creditor Reference”, or SCOR for short) starts with the letters “RF”, followed by five to 25 characters. It complies with the international ISO 11649 standard, which means it can be used for international payment transactions.

-

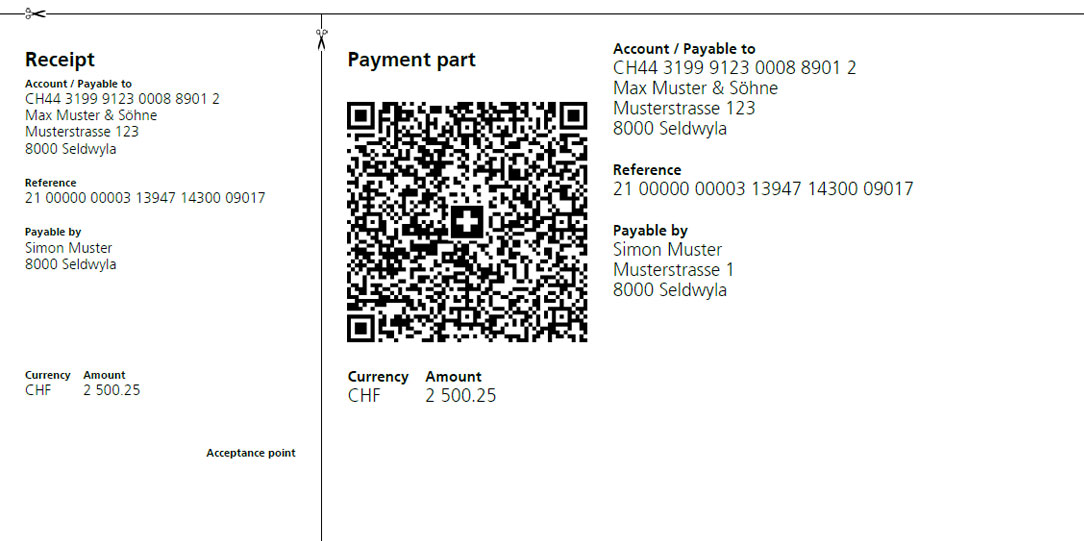

The QR-bill consists of

- A payment letter, e. g. with information on the invoice items

- A payment part with a QR code and receipt

The QR code contains all the necessary payment information in a coded, digitally readable form. This information is also all printed in text form.

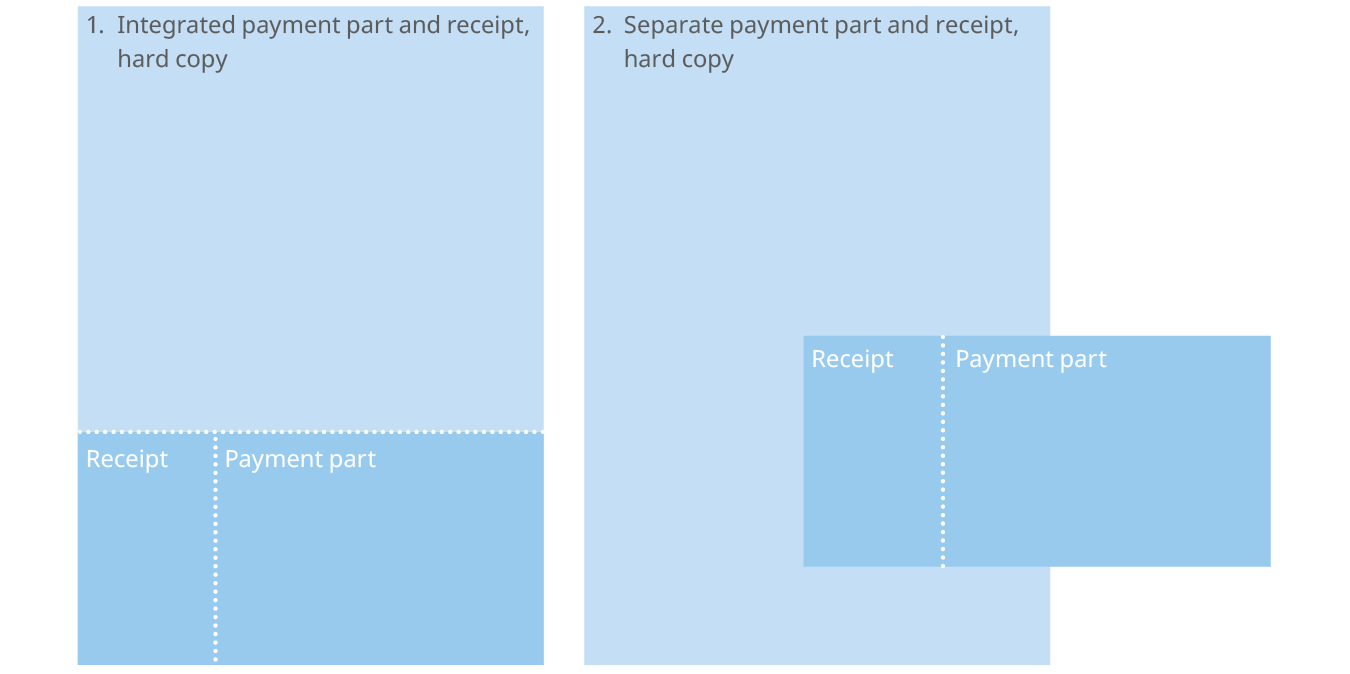

The payment letter and the payment part with a QR code and receipt may be on a page/sheet or on separate sheets/pages.

The payment part with a QR code and receipt must be placed at the bottom of the page in both instances.

-

The QR code contains

- Information on the payment recipient

- Information on the debtor

- The invoice amount

- The currency (CHF or EUR)

You will find a complete list of all the information it contains here: “The link will open in a new window Swiss Implementation Guidelines QR-bill”.

-

QR-bills can be issued in Swiss francs or euros. The currency initials (CHF or EUR) must be printed to the left of the amount/amount field on the payment part and receipt.

-

The QR-bill was developed only for payments made within Switzerland and Liechtenstein. This means that its format (including payment part and receipt) and the scanning and processing of the QR codes are only valid for payment transactions in these two countries.

The QR-bill does, however, contain information that you can use for cross-border payments entered manually. This includes the payment recipient’s name and address, the amount, the IBAN and the Creditor Reference.

This gives us two scenarios for international payments with QR-bills:

Invoice issuer abroad – Invoice recipient in Switzerland or Liechtenstein

The invoice recipient can only use the QR-bill functions (scanning/reading the QR code) if the invoice issuer provides an IBAN or Creditor Reference for an account in Switzerland or Liechtenstein. Otherwise, the invoice recipient must activate a manually entered international payment in their online or mobile banking account.

Invoice issuer in Switzerland or Liechtenstein – Invoice recipient abroad

Whether payments from abroad to Switzerland (or Liechtenstein) are possible with QR-bills depends on whether the respective foreign bank supports the Swiss QR-bill. The Swiss financial center has no effect on this. It is conceivable there are similar services in neighbouring regions. In this case too, it’s possible for the foreign invoice recipient to use the information on the QR-bill for a manual payment.

Creating and designing QR-bills

-

You will find all design requirements and recommendations in the document “The link will open in a new window Swiss Implementation Guidelines QR-bill” and in the “The link will open in a new window Style Guide QR-bill”.

-

The QR reference can be used as a structured reference, and it helps match incoming payments to the relevant invoice in a straightforward, automated manner.

The QR-IBAN is a special IBAN (International Bank Account Number) used on QR-bills with QR reference. You have received your QR-IBAN from PostFinance. If you do not know your QR-IBAN, contact your Customer Advisor.

Please note: If you issue a QR-bill with QR reference, you must enter your QR-IBAN.

-

Yes, the debtor’s name (and, optionally, the address) and amount must actually be added in writing later on if these details are not already printed on the payment part and receipt. In this case, enter the information in the fields with corner marks.

Handwritten messages are, however, not permitted.

-

According to the FINMA Anti Money Laundering Ordinance, this is required if the QR-bill is being paid at a Swiss Post branch.

We do, however, still recommend entering the full address.

Please note: if the invoice recipient’s name and full address is not contained in the QR-bill or printed on the visible part of the bill, the information will subsequently be entered at the Swiss Post branch. Please bear in mind that this will entail fees for the recipient.

-

Create individual QR-bills very easily with the QR generator. You can find it at postfinance.ch/qr-code-generator and in e-finance.

If it’s not just individual QR-bills you need to send, but small volumes as well, you can have them created at Swiss Post branches.

The link will open in a new window Find out more about creating QR-bills with Swiss Post

-

No, we do not provide an order service for perforated A4 paper. However, you will find this sort of paper in the majority of print shops, stationery shops or the The link will open in a new window Postshop.

-

Yes, if you intend to send the QR-bill in paper format, it must be perforated.

If you intend to e-mail the QR-bill as a PDF to the invoice recipient, it must be provided with lines and a scissor symbol for separating the payment part and receipt. This will indicate to the debtor that the payment part and receipt must be cut apart if the QR-bill is forwarded by post to a financial institution for payment, or if it is paid at a Swiss Post branch.

Please bear in mind that QR-bills in PDF format are primarily suitable for e-banking or mobile banking payments. They are not as suitable for paper-based, over-the-counter payment transactions, or for payments by payment order.

-

No, that is not allowed. A QR code for payments may only be used in the context of a complete QR-bill and/or on a payment part.

Paying QR-bills

-

Messages can be printed on all QR-bills.

Please bear in mind: the message must be printed and placed to the right of the QR code – and it is also contained within the QR code. Handwritten additions to the message are not permitted.

-

Generally no.

A manual payment can be entered online or via mobile banking. In the majority of cases, it’s enough to enter the IBAN, the payment recipient’s name/town, the amount and, so the payment can be categorized, a message.

If you provide all the relevant information, you can order a donation at the counter of a Swiss Post branch. Please bear in mind that this will entail fees for the recipient.