In order to successfully build assets, you should first be aware of your personal goals and requirements in order to find the investment strategy that works best for you. Remember that it’s never too late or too early to invest money. And even small amounts will enable you to build up assets if your investment horizon is long. But don’t allow yourself to get flustered by the ups and downs in the financial market – with long-term investments, there will always be phases during which prices will drop. You shouldn’t panic if prices go down or immediately increase your investment if prices go up. Keeping your cool is the name of the game, especially when prices fall. A longer investment horizon also enables you to take more risk. With long-term investments, your portfolio is better able to cope with short-term setbacks or stock market corrections, as the natural volatility of the market will often correct short periods of negative performance. Even if the stock market is affected by constant ups and downs, prices have risen on average in the past − and this is something you can benefit from with a long-term investment strategy.

You are here:

Long-term investments – why it’s important

Whether short-term or long-term: there are numerous options for investing money. A short-term investment offers the advantage that investors can access their funds after a short period of time. A savings account, for instance, is a good option in this case. But to save for retirement or to achieve more major financial goals, you should consider a long-term investment.

Benefit from the compound interest effect by making regular payments

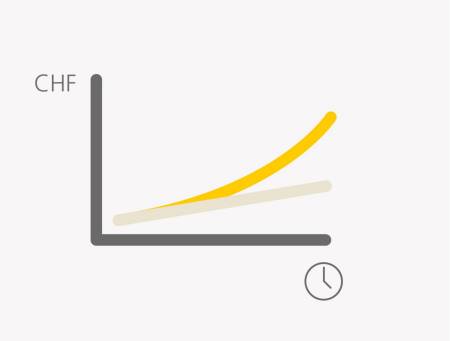

Building up assets in the long run doesn’t just mean making regular investments over an extensive period of time (through a funds saving plan, for example); it also means leaving the investments untouched. A 35-year-old who invests CHF 200 a month at 4% over 30 years will have pension fund assets of almost CHF 140,000 by the time he or she reaches 65. If the saving plan was started when that person was 25, he or she would receive almost CHF 100,000 more, having paid in only an additional CHF 24,000. The ten extra years of saving create extra interest of around CHF 70,000.

Don’t rely on short-lived trends for building up assets in the long term

Anyone who would like to build up assets in the long term should try not to be blinded by short-lived trends. Much-hyped products and companies can turn out to be pure speculative bubbles – as was the case with the dot-com bubble in the 1990s. The euphoria associated with revolutionary tech firms led thousands of people to invest in dot-com companies and lose a proportion of their assets as the hype levelled off. Read more about speculative bubbles and how they develop in the article "What is a speculative bubble?". The old rule still applies: if it seems too good to be true, it’s probably not true. Long-term investors should therefore focus on long-term supertrends rather than short-term hype.