They have strong growth potential, a solid financial basis and promising future prospects – most SMEs tick all these boxes rather than offering world-famous company names and products. Switzerland is traditionally regarded as a country of SMEs: according to the Federal Statistical Office (FSO), more than 99% of all Swiss companies are SMEs, representing two-thirds of all the jobs in Switzerland. Those who opt for small and medium-sized enterprises invest in what are known as small caps and mid caps. As the name suggests, these are companies with low to medium market capitalization . The equivalent for large companies is large caps, also referred to as blue chips – these include the largest and most liquid securities on the Swiss stock market, such as those represented in the SMI.

You are here:

Small and mid caps: invest money in small and medium-sized enterprises

Investing is not just about investing money in large, international companies. Small and medium-sized enterprises (SMEs) also offer attractive potential returns. Find out here how SMEs differ from large companies and learn about the investment opportunities available.

Small cap premium: greater returns with SMEs

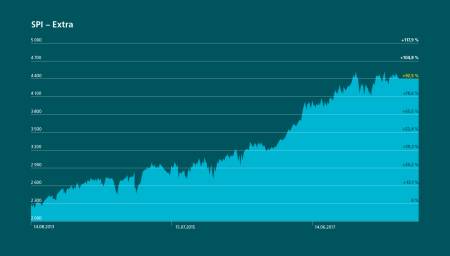

The SPI Extra Index shows how attractive small and mid caps can be. It consists of around 191 small and mid cap shares listed on the Swiss stock exchange. The SPI Extra has generated returns of 92% over the past five years. One of the reasons for this is that some of the SMEs represented in the SPI Extra have particularly high growth rates. In addition, smaller companies often act more quickly due to their shorter decision-making processes, which allow them to adapt to market requirements. The so-called small-cap premium, i.e. the fact that shares in smaller companies yield more profit, does not just apply in Switzerland, but worldwide. Yet many Swiss investors invest predominantly in national and international blue chips. They run the risk of not diversifying their portfolio sufficiently. Although they are investing in a range of industries or countries, they are restricting themselves to large companies. By investing in small caps, investors can diversify their portfolio to include different sized companies, spreading their risk more broadly as a result.

SPI − extra

Invest in small and mid caps with funds

Investing in SMEs is not as difficult as some people might think. Small and mid caps often have strong shareholders behind them who hold large proportions of shares in the long term (these are known as core shareholders). Sufficient shares nevertheless remain available on the market for small investors. There are funds specializing in Swiss small and mid caps, for example, which investors can invest in even with a small amount of starting capital. An overview of the most common types of funds can be found in the article “What different types of funds are available?”. Investors who want to invest internationally can also choose from a variety of small cap funds from other industries or countries. Small and mid caps can therefore be of interest to many investors – either to balance an overweighting in blue chips or to benefit from the development of selected SMEs in a targeted manner.