You are here:

A passively or an actively managed fund – what’s right for me?

When investing in funds, you can choose between two different types: actively and passively managed funds. Each of these methods involves particular advantages and disadvantages. This often makes it difficult for investors to decide on the best strategy. Our comparison sheds some light on this matter.

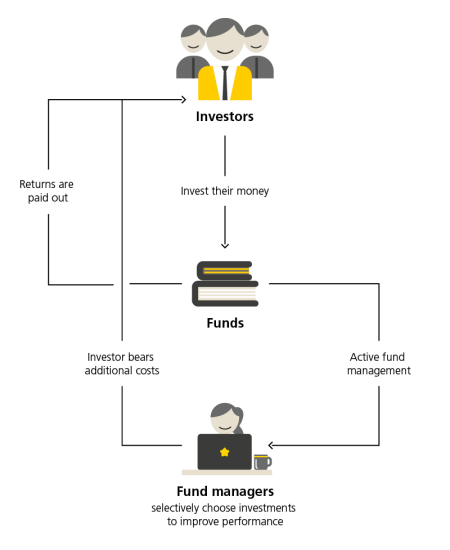

Active fund management

With active management, a fund manager is used and expressly given the goal of outperforming a particular index. Fund managers decide on the composition of the fund , select the securities according to specific criteria and make changes if necessary. They may, for example, buy more of a particular share or group of shares (overweight) or, alternatively, fewer of them (underweight) if they believe a company or sector will perform strongly or poorly. Through such proactive decision-making, they aim to outperform the benchmark index (for example, the SMI or FTSE).

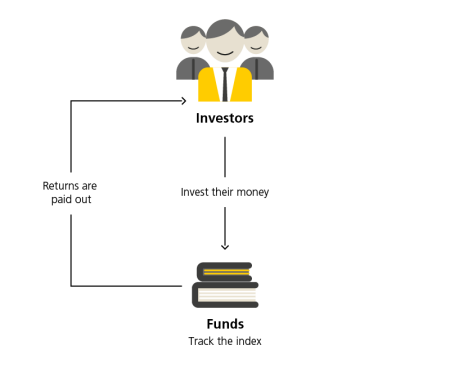

Passive fund management

Passively managed funds (often referred to as index funds or ETFs) always track an index. In contrast to actively managed funds, they do not attempt to outperform the benchmark index but instead track it as closely as possible. Investors who put their money into a passively managed index fund on the SMI, for example, are specifically investing in the 20 largest shares in Switzerland.

Do higher fees mean better performance?

This means that passive funds do not provide an opportunity for outperforming the index tracked. By contrast, this is possible with actively managed funds, but only if fund managers and their teams succeed in constantly generating a higher return than the index based on well-founded decisions. Investors incur higher costs for this as the fund managers select the securities based on their own evaluation and analyses, which leads to higher expenses. This is why it’s important to compare the performance of active and passive funds after deduction of the fees. If the active fund produces better net return than the passive fund in such a comparison despite the higher costs, this is no guarantee for the future, but it is a strong indication that the fund manager has selected the securities wisely. However, it may be difficult for many fund managers to consistently outperform the market.

A combination of active and passive management styles

Investors don’t necessarily have to choose between actively or passively managed funds as there are now also funds that mix active components with passive ones, providing a combination of both management styles. The fund manager decides which components to manage actively and which will remain passive. These funds aim to combine the benefits of both management styles.

Which investment style is right for me?

Whether active, passive or mixed – the key factors in your choice are ultimately your personal outlook and investment objectives. If you have decided to invest and are comparing funds with different management styles, the net return can be a good comparative indicator. What’s important is not short-term comparison but a comparison over the last three to five years. Alternatively, you could consult independent financial sites online. When making your choice, you shouldn’t expect to have the best-performing product in your custody account at all times. If it’s in the top third, it’s performing well. Your investment advisor would be pleased to help you with selecting the right funds.