A lot of bank customers have specific things they would like to do with a particular sum of money at a very specific time. If this time is not 5, 10 or maybe even 20 years in the future, then perhaps time deposits and fixed-term deposits are sensible investments. After all, with fixed-term deposits and time deposits you can be flexible in how you invest your money: you personally determine how much you invest, as well as the term (depending on the bank) of your investment. Your bank will then invest your capital at a fixed interest rate, which is something that is set based on the current market rate. This means investors can invest unneeded capital and enjoy a greater return than what they would expect to receive with a conventional savings account or private account.

You are here:

Fixed-term deposits and time deposits – invest money in the short and medium term

Want to invest your money in the short and medium term? If so, a fixed-term/time deposit may be exactly what you’re looking for. With a fixed-term/time deposit, you will be able to invest your money for a certain period of time. This can make your money go further even with a short- or medium-term investment horizon, and help you make your dreams, such as owning your own home or car, a reality.

What exactly are time deposits, fixed-term deposits and notice deposits?

What exactly is a time deposit? Time deposit is the umbrella term for all investments with banks that have a fixed term or a pre-determined notice period. There are two types:

Fixed-term deposit

The term fixed-term deposit comes from the fact your money is invested at a fixed interest rate for a specific period of time. Generally speaking, the higher the investment, the shorter the minimum term. That said, the exact conditions for a fixed-term deposit vary from provider to provider.

Notice deposit

For notice deposits, an amount is invested for an indefinite period and at no fixed interest rate, though it is subject to a notice period if the capital is required. As soon as the notice has been submitted, the subsequent process is similar to that of a fixed-term deposit: a fixed interest rate is agreed upon, and, once the notice period has expired, the sum plus return is transferred back to the investor.

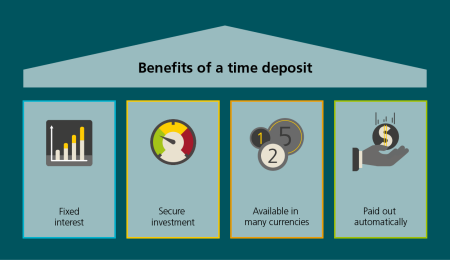

Benefit from higher returns and a shorter term

If someone potentially has a surplus amount in their account at the end of the year and is looking to invest this for a certain period of time, they can do so with time deposits. This usually involves higher sums (CHF 100,000 +), and minimum sums vary between banks. At the end of the investment term, the sum plus interest is transferred back to your account automatically. In Switzerland, this interest is subject to a withholding tax of 35% regardless of your bank, and this must be paid. When it comes to notice deposits, investors agree a particular notice period of, say, 30 days with the bank. In other words, investors must actively cancel their investment so they can recover their notice deposit. There is no notice period for fixed-term deposits. These have a fixed term, usually between one week and twelve months depending on the size of the investment. Unlike notice deposits, fixed-term deposits cannot be cancelled during this period. However, investors do benefit from better conditions and a low risk of loss. Statutory depositor protection applies to all banks operating in Switzerland that are subject to supervision by the Swiss Financial Market Supervisory Authority (FINMA). Deposits and, in turn, fixed-term deposits totalling up to CHF 100,000 per customer are covered by statutory depositor protection.

How can I invest fixed-term deposits?

You can open a new fixed-term deposit account either online or over the phone with the majority of banks, and you will be able to make money market transactions with a fixed maturity date, sum and interest rate. These are also usually possible in different currencies. Find out more about what your bank has to offer or ask your bank for advice.

Find out more about PostFinance’s range of offers on the page “Fixed-term deposits - benefit from higher potential returns”.