valid from 16.04.2024

You are here:

Model portfolios – Swiss focus

Rotation

In the USA, we are seeing what we have been pointing out for some time: Progress in the fight against inflation is stagnating. The overall inflation rate has risen from 3.2 per cent to 3.5 per cent, while the inflation rate excluding volatile price components remains at a high 3.8 per cent. This means that key interest rate cuts in the USA are moving further into the distance. This creates downside potential for interest rate-sensitive stocks such as technology stocks in the US equity market in particular. In contrast, value stocks have proven to be more resilient in the past in an environment of higher interest rates. We therefore recommend buying global value stocks at the expense of the technology-dominated US equity market.

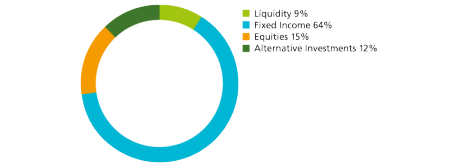

Interest income

Income

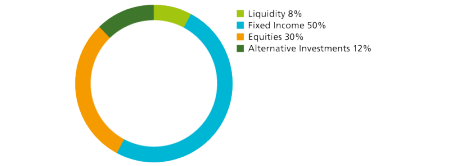

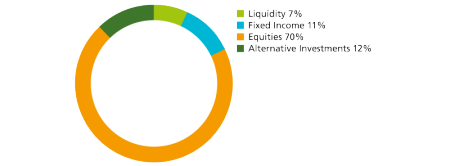

Balanced

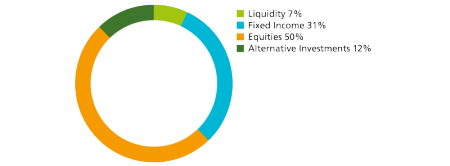

Growth

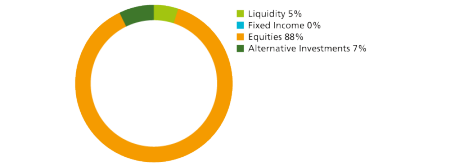

Capital gains