Benefits from the first and second pillars aim to guarantee your accustomed standard of living in later life or in the event of disability or death. Private retirement saving solutions as part of the third pillar fill any gaps in coverage based on your individual situation and needs.

You are here:

Retirement planning facts

Everything you need to know about retirement planningThose who want to maintain their accustomed standard of living after retirement should not only rely on AHV and pension fund benefits. With the right retirement planning solution, you can protect yourself and your loved ones from financial worries in later life or in the event of incapacity to work or death. PostFinance offers tax-privileged retirement savings solutions that allow you to achieve your individual savings goals.

-

First pillar: state pension

The first pillar represents AHV (old-age and surviving dependants insurance). The state pension also includes IV (disability insurance), EO (compensation for loss of earned income during military service) and ALV (unemployment insurance). All people living or working in Switzerland are covered by mandatory AHV/IV insurance.

However, AHV/IV insurance is often no longer sufficient to secure a minimum level of income. As such, supplementary benefits may be claimed depending on pensioners’ asset and income situation.

Second pillar: employee benefits

The second pillar is enshrined in the BVG (Swiss Federal Law on the Occupational Old-age, Survivors’ and Disability Benefit Plan) and UVG (Accident Insurance Act). The group of people insured under the second pillar is limited compared to the first pillar.

Employees with income of more than CHF 22,050 (as of 2024) are automatically insured by their employer’s pension fund as part of their occupational pension. Together with the benefits under the second pillar, the benefits under the first pillar aim to allow pensioners to suitably maintain their previous standard of living.

The UVG has been mandatory for all employees since 1984 and the BVG since 1985. Self-employed people may obtain insurance under the second pillar on a voluntary basis.

Third pillar: private pensions

However, the first two pillars do not always achieve their goals. For this reason, the state supports the private pensions enshrined in law as part of the third pillar.

In the third pillar, a differentiation is made between tax-privileged fixed pension plans (pillar 3a) and the flexible savings offered by flexible pension plans (pillar 3b).

Contrary to mandatory AHV insurance and pension funds, private pensions can be designed flexibly and according to pensioners’ needs.

First pillar

State pensionSecond pillar

Employee benefitsThird pillar

Private pensionFirst pillar State pension Secures a minimum level of incomeSecond pillar Employee benefits Maintains accustomed standard of livingThird pillar Private pension Individual top-up to fill gaps in coverageFirst pillar State pension - AHV/IV

- Supplementary benefits

Second pillar Employee benefits - Mandatory BVG/UVG

- Supplementary pension provision

Third pillar Private pension - Fixed pension plan 3a

- Flexible retirement savings account 3b

-

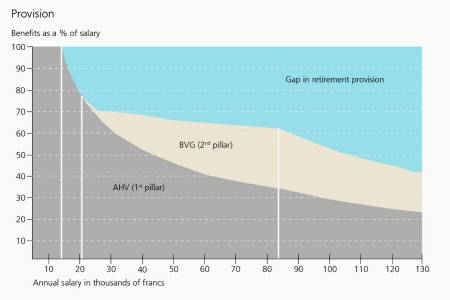

Under the first and second pillars, incomes of employees up to CHF 88,200 (as of 2024) are insured. For an income within this bracket, benefits from state and occupational pensions cover only around 60% of previous earnings. With the wide range of solutions under the third pillar, gaps in coverage due to individual needs can be filled in a targeted manner.

The statutory pension and pension requirements that arise as a result: the graph shows the maximum statutory benefits for single women and men.

Private pensions fulfil different goals

- With a retirement savings account 3a, you can flexibly provide for a financially secure retirement and save on taxes at the same time. Thanks to the option to invest retirement assets fully or partially in retirement funds, you retain the opportunity for higher returns in the long term.

- You can achieve a long-term savings goal or safeguard against the financial consequences of incapacity to work or death. Protect yourself and your loved ones with life insurance.

- If you permanently or temporarily give up employment, a vested benefits account offers an ideal way to guarantee the receipt of retirement funds from your occupational pension (pension fund).

- Fulfil your dream of owning your own home. Retirement planning solutions can be used to finance or amortize an owner-occupied home.

-

There are hardly any retirement planning goals that cannot be achieved with the retirement planning solutions from PostFinance. The sooner you get to grips with your personal retirement planning situation, the more relaxed you can be about your future.

Good reasons for a retirement planning solution

There are a wide range of reasons to choose a retirement planning solution:

- Building assets and achieving individual savings goals

- Planning for a financially worry-free retirement

- Financial security for loved ones or business partners in the event of death

- Protection from the financial consequences of incapacity to work

- Saving on taxes and optimizing your tax burden

- Financing and amortizing an owner-occupied home

- Receiving retirement funds from your employee benefits

Examples of retirement planning solutions

Each phase of life has its own particular characteristics. In addition, everyone has their own goals and desires for the future. People’s requirements for and ideas of individual retirement planning are just as varied.

Early retirement planning pays off

For working people without family or financial obligations, flexible payment into a retirement savings account 3a is recommended. It’s best to start as early as possible. Even small private retirement provision contributions make a large contribution towards a future free of financial worries. Interest-bearing savings deposits benefit from the compound-interest effect. Opportunities for returns can be increased with the option to invest in retirement funds. Payments into a retirement savings account 3a can be deducted from your taxable income.

Protect your family

For families, protection against the financial consequences of death or incapacity to work is essential. A reduced income can have an effect on the provision of childcare or home care and the ability to buy your own home. With life insurance or insurance against incapacity to work, you can protect your loved ones from financial difficulties.

The dream of your own home

Saved retirement assets from private pensions can be used to finance an owner-occupied home. Those who want to realize their dream of owning their own home stand to benefit from building their equity at an early stage. Payments into a retirement savings account 3a or a capital-growth life insurance plan can be used both to build assets and amortize a mortgage.

Plan your retirement

People today are living longer and more healthily thanks to advances in medical science. This means they are more active during their well-deserved retirement. Flexible retirement or realizing long-held dreams must be able to be financed. Retirement planning solutions with capital growth such as the retirement savings account 3a and life insurance can be acquired individually or in combination with other savings and investment types to secure a more financially independent future. Tackle your pension planning at an early stage.

Receipt of employee benefits

Pension funds are a key component of personal retirement planning. Those who permanently or temporarily give up employment must invest their saved retirement funds (pension fund) as part of a vested benefits solution. The vested benefits account offers a range of ideal options. Note that changes in your professional and private life can have an influence on your retirement planning needs. Please therefore check your retirement planning situation on a regular basis.

-

In terms of private pensions, a distinction is made between “fixed” and “flexible” financial services solutions. The main differences relate to the availability of benefits, tax treatment and treatment under inheritance law.

A brief explanation of fixed & flexible pension plans

In terms of fixed pension plans (pillar 3a), the time of payment, among other aspects, is governed by law. In return you can enjoy multiple tax benefits. Fixed pension plan products are the 3a account solution and 3a life insurance.

Flexible retirement plans (pillar 3b) can most easily be described as targeted savings. There are fewer tax benefits than offered by fixed pension plans. Flexible pension plans include assets such as savings accounts, investment funds, shares, bonds and 3b life insurance.

Availability

Fixed pension plan (pillar 3a) Flexible retirement savings account (pillar 3b) Fixed pension plan (pillar 3a) - Generally when you reach AHV retirement age

- Maximum of 5 years before statutory retirement

- For purchasing an owner-occupied home

- For amortizing a mortgage

- When taking up self-employment

- When emigrating from Switzerland

- For buying into a pension fund or another fixed pension plan

- When drawing a full disability pension

Flexible retirement savings account (pillar 3b) - Payout can generally be freely specified. If any contractual product terms and conditions are not complied with, financial losses may be incurred upon early termination.

Tax benefits

Fixed pension plan (pillar 3a) Flexible retirement savings account (pillar 3b) Fixed pension plan (pillar 3a) - Inpayments may be deducted from taxable income up to the statutory deduction limits

For persons subject to withholding tax: payments into pillar 3a can only be taken into consideration for tax purposes if a retroactive standard assessment is carried out. Check with a tax expert to find out whether it is worthwhile paying into pillar 3a. - No income tax or wealth tax is levied during the term

- Payout takes place separately from other income at a reduced tax rate (depends on canton and municipality).

Flexible retirement savings account (pillar 3b) In contrast to fixed pension plans, flexible pension plans do not enjoy any general tax privileges. Payments into pillar 3b cannot generally be deducted from taxable income. Please note the tax treatment in your canton of residence. For certain products, the flexible pension plans may offer tax benefits. For example, payouts from 3b life insurance policies are generally tax-free (specific rule for unit-linked life insurance and single-premium life insurance).

Beneficiary clause

Fixed pension plan (pillar 3a) Flexible retirement savings account (pillar 3b) Fixed pension plan (pillar 3a) Governed by law:

- The surviving spouse or registered partner

- Direct descendants and natural persons who were supported to a significant degree by the deceased person. Or the person who lived in a partnership with the deceased for the last five years prior to his/her death or who has to provide financial support for one or more common children.

- Parents

- Siblings

- Other heirs, excluding the municipal authority

Customers are entitled to define one or more people set out under section 2 as beneficiaries and stipulate their entitlements in more detail or change the order of beneficiaries under sections 3–5 in writing.

Flexible retirement savings account (pillar 3b) - May be freely chosen subject to statutory mandatory portions.