Precondition

You must have a PostFinance private account in EUR to obtain a PostFinance Card in EUR.

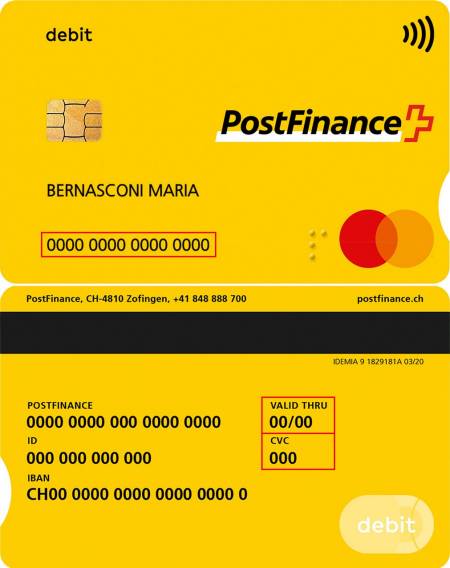

The PostFinance Card in EUR is your free card for your private account in EUR. Thanks to the combination with Debit Mastercard®, you can shop or withdraw cash with ease worldwide. With no currency conversion losses for withdrawals in EUR.

Withdraw cash in EUR or CHF at Postomats, ATMs and post offices throughout Switzerland

Make contactless payments in store and online worldwide thanks to the combination with Debit Mastercard

Withdraw cash worldwide at ATMs

You must have a PostFinance private account in EUR to obtain a PostFinance Card in EUR.

You can pay with your PostFinance Card wherever the PostFinance or Mastercard logo is displayed.

When making your first contactless payment, a transaction using your PIN is required.

Pay conveniently in online shops with your PostFinance Card. Where this isn’t an option, choose “Mastercard”, and you can still pay with your PostFinance Card – anywhere in the world.

In the online shop, select the “Mastercard” option and follow the instructions. In most cases, you will have to enter the following data from your card (additional checks are at the merchant’s discretion):

Pay securely with your PostFinance Card. If you make the payment with Mastercard, the globally accepted 3-D Secure procedure is used. You can activate 3-D Secure in e-finance or in the PostFinance App. You must have a Swiss mobile phone number.

Cash withdrawals at ATMs in Switzerland are free of charge with the SmartPlus, SmartYoung or SmartStudents banking package. With the Smart banking package, withdrawals of euros cost CHF 5 and withdrawals of Swiss francs cost CHF 2. Since 13 December 2022, cash withdrawals at ATMs have only been be available with the PostFinance Card combined with Debit Mastercard.

Please note the information on withdrawing money at ATMs in the Mastercard networks. The information does not originate from PostFinance and no responsibility is accepted for its accuracy. Since 11 september 2023, cash withdrawals abroad have only been available with the PostFinance Card combined with Debit Mastercard.

Activate geoblocking to restrict cash withdrawals made with the PostFinance Card to specific geographical areas abroad.

| Withdrawals | In EUR |

|---|---|

| Withdrawals Cash withdrawals per day |

In EUR EUR 800 |

| Withdrawals Goods purchases per day for online shopping |

In EUR EUR 2,000 |

| Withdrawals Monthly limit per card |

In EUR EUR 4,000 |

| Withdrawals Monthly limit per account |

In EUR EUR 4,000 |

| Withdrawals Withdrawals at post offices |

In EUR Account balance in terms of cash holdings |

You can set the withdrawal limits yourself in e-finance, in the PostFinance App or by telephone.

The PostFinance Card in EUR is free of charge.

| Place of use | Cost of cash withdrawals |

|---|---|

| Place of use Postomats |

Cost of cash withdrawals Free of charge |

| Place of use Post office counters |

Cost of cash withdrawals Withdrawals in Swiss francs: free of charge Withdrawals in euros: 1% of cash sum withdrawn |

| Place of use ATMs in Switzerland |

Cost of cash withdrawals Smart banking package: SmartPlus, SmartStudents and SmartYoung banking packages: free of charge |

| Place of use ATMs abroad |

Cost of cash withdrawals Smart banking package: CHF 5 |

| Place of use Purchase of goods/services |

Cost of cash withdrawals A processing fee of 1.5% applies on purchases made abroad (goods or services bought in shops and onlineincl. online shops of foreign retailers). This also includes recurring services (e.g. music subscriptions) from online shops that are processed abroad. |

Card blocking Via hotline/customer advisor |

CHF 20 per report |

Card replacement Via hotline/customer advisor |

CHF 40 per card |

PostFinance Card with Debit Mastercard:

PostFinance credit card:

For amounts up to CHF 500 or EUR 350 per month, the card and ID number of the PostFinance Card must be entered in the payment screen.

For amounts exceeding this limit, the personal PIN for the PostFinance Card and the card reader are also required.

There is a monthly limit if multiple cards belong to the same account (e.g. partner account). The limit per account is defined here on the basis of the limit per card.

You can enter individual card limits directly in e-finance or the PostFinance App.

Choose ATMs that don’t charge any commission or withdrawal fees. If fees apply, they will be indicated during the cash withdrawal. If this is the case, cancel the operation and find another ATM.

You can block/unblock your PostFinance Card or order a replacement card quickly and easily online.